Many startups find their success by introducing easier and more efficient ways to do things. From lightning-fast search engines to anonymous cryptocurrency, the range of bold innovative ideas is vast.

The common theme, however, seems to be the desire for speed and minimal effort for the user. How do venture capitalists decide which startups to invest in? It takes a keen eye, an understanding of the market, as well as a finger on the pulse of the current trends.

One trend that is on the rise is startups that implement the use of Artificial Intelligence. These new ideas range from A.I. customer support systems to A.I. Healthcare systems. It is easy to see why this trend is so exciting for many business owners and venture funds.

Increased Funding

The total funding for A.I. startups in 2017 was three times the size of funding in 2016 and will most likely continue to grow. The culmination of 550 A.I. startups raised $5 billion in funding in 2016 alone. Why is it that so many Investors want to get involved with this new trend?

The main reason is that most business owners are excited about A.I. startup products. An even more exciting possibility is that many startups are developing affordable A.I. products that even small businesses will be able to afford.

Startup Rush

It’s no secret that A.I. products are hot right now, but the verdict for which companies will be the most successful and widely used is still out. Many big companies like Google and Apple are in a rush to stockpile the most promising companies first.

Google is currently in the lead with 14 A.I. startup acquisitions including Halli Labs, a young company based in Bengaluru, India that is working to build A.I. tools and is focused on deep learning and machine learning systems. It seems the future holds more and more A.I. solutions. How that will affect businesses and users of the products, in general, is still to be seen, but excitement seems to be the overall mood at the moment.

Venture Capitalist Influence

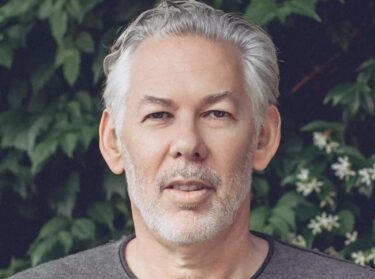

As we look at this trend in startup products, it is also important to take note of the people who make the trends skyrocket. These people are the risk takers, like venture capitalists, who see the potential in startups and invest in them. Aside from reading various startup news mediums, keeping track of startup trend influencers is a fantastic way to stay in the loop. Check out the Chris Sacca LinkedIn page for an example of a venture capitalist who has had success by knowing when and where to invest.

Chris Sacca is not alone in the growing number of venture capitalists who are nurturing young companies into adulthood, but he is a sterling example of someone with incredible investment instituition. He started out his career as General Counsel for Speedera Networks and then landed the role of Head of Strategic Initiatives at Google in 2003. With considerable credit and experience, Sacca founded his own company, Lowercase Capital, in 2010. It has since become a major venture fund in America.

The fact that Chris Sacca had the foresight to invest in tech companies like Twitter and Uber when they were only in the seed stage of development is proof that he has extraordinary bravery and talent when it comes to spotting major investment opportunities.

Lowercase Capital currently manages over 80 startups, including A.I. reliant products. The company works under the belief that investment is just part of the growth process for seedling companies. It is with this level of insight and confidence that venture capitalists can contribute to the advancement of young companies that have the potential to change the world.

Startup Process

The process of a startup company growing to adulthood is a long and winding road. Funding is essential for many companies if they want to grow and get their product to the population at large. When a venture capitalist decides to take on a startup, they invest money into the company and develop a partnership with the creators. The stages at which a startup company can be acquired are often categorized as follows:

- Seed Stage: This is the very early stage of a startup when the focus of the investor is on product development and team expansion.

- First Stage: At this stage, financing goes to commercial manufacturing.

- Formative Stage: If a venture capitalist takes on a startup at this stage, the financing is used for seed stage to early stage.

- Expansion Stage: At this point, the financing moves the startup towards commercial sales.

- Mezzanine Stage: In this category, the V.C. helps the startup to go public with its product.

- Balanced-stage: When a startup is categorized as a balanced-stage, the financing goes to all stages, from Seed to Mezzanine.

It seems the future is one filled with an expanse of revolutionary A.I. inventions. With A.I. paving a new path for easy to use health care systems, cybersecurity, and a slew of other products created to make lives easier, its difficult to look forward without at least a whisper of excitement and admiration for the teams behind these creations and those who believed in them from the start.