Unelected globalists and governments alike are pushing digital identity schemes through multiple entry points including climate, COVID, cybersecurity, and CBDC.

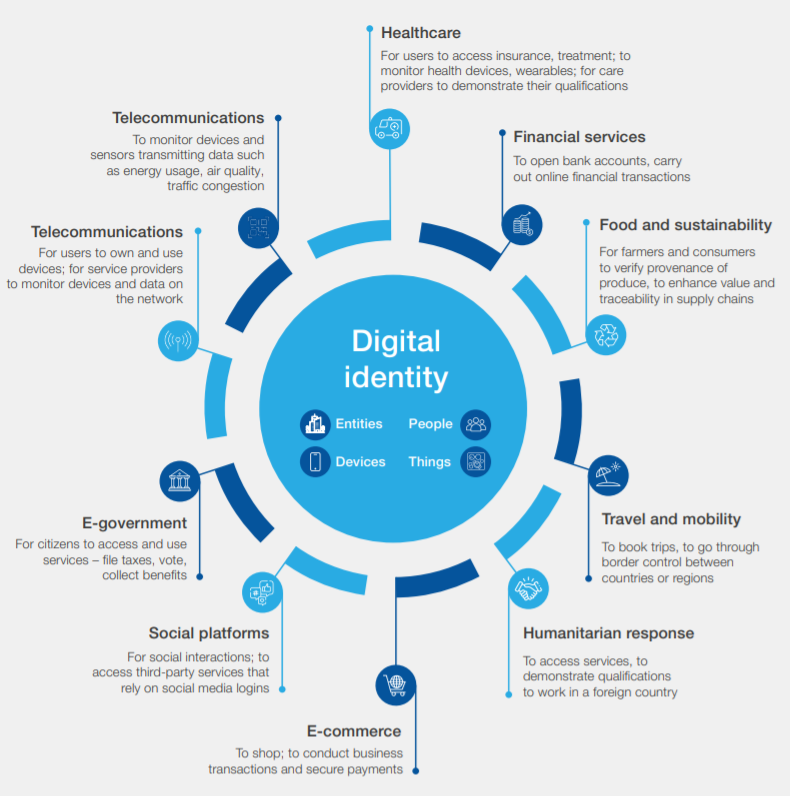

These digital ID entry points include, but are not limited to:

- Digital ID for Climate: To track individual carbon footprints and prove climate refugee statuses

- Digital ID for COVID: To mandate vaccines passports leading to mass compliance while providing the digital framework

- Digital ID for CBDC: To adopt identity verified solutions in order to eliminate anonymity and record every transaction

- Digital ID for Cybersecurity: To exploit cyberattacks as a means to kickstart national identity systems and to create a passport to the metaverse

- Digital ID for Convenience: To create an all encompassing, interoperable framework in order to enable all life situations

A digital identity encompasses everything that makes you unique in the digital realm, and it is a system that can consolidate all of your most personal intimate data, including which websites you visit, your online purchases, health records, financial accounts, and who you’re friends with on social media.

It can be used to determine what products, services, and information are available to you, and it can certainly be used by public and private entities to deny you that access.

Here’s a further look at some of the many ways in which governments and unelected globalists are pushing the digital identity agenda.

“This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us” — World Economic Forum

From Carbon Trackers to Refugees: Using Climate as a Catalyst for Digital ID

At WEF 2022 in Davos, Alibaba Group president J. Michael Evans announced that the platform would rollout an individual carbon footprint tracker, along with a SaaS application for businesses to track their carbon footprints for Environmental, Social, and Governance (ESG) purposes.

The carbon footprint tracker looks to operate similarly to the Chinese Communist Party’s (CCP) social credit system by rewarding people who “do the right thing” while punishing those who “do the wrong thing.”

“Individual carbon footprint tracker, stay tuned! We don’t have it operational yet, but this is something we’re working on” — J. Michael Evans, President of Alibaba Group, WEF 2022

“At a billion consumers, we’re developing, through technology, an ability for consumers to measure their own carbon footprint,” Evans told the unelected globalists at Davos during the “Strategic Outlook: Responsible Consumption” session.

“What does that mean?” he went on to say.

“That’s where they’re traveling, how they are traveling, what are they eating, what are they consuming on the platform.

“So, individual carbon footprint tracker, stay tuned! We don’t have it operational yet, but this is something we’re working on.”

Measuring individual carbon footprint is one thing; however, if governments mandate the tracker as a matter of policy for punishing or rewarding behavior, then it becomes yet another form of digital identity that can be used to enforce a system of social credit.

And with Alibaba’s plans to introduce a “green travel” scheme that awards bonus points to those who comply, the Alibaba president admitted that the plan was to incentivize customers “to do the right thing,” which is the same method the Chinese Communist Party uses for its authoritarian social credit system.

“If they take advantage of those recommendations, we’ll give them bonus points that they can redeem elsewhere on our platform. So, they’re incentivized to do the right thing even if they were provided with the opportunity to decide to do the wrong thing” — J. Michael Evans, President of Alibaba Group, WEF 2022

On the issue of “green travel,” Evans explained, “What we’re going to do is allow people to first calculate the best route, the most efficient route and also the most efficient form of transportation.

“And then if they take advantage of those recommendations, we’ll give them bonus points that they can redeem elsewhere on our platform.

“So, they’re incentivized to do the right thing even if they were provided with the opportunity to decide to do the wrong thing.”

According to Evans, “the right thing” for travelers to do is to use the routes and forms of transportation that the Alibaba algorithm recommends.

“The current refugee crisis and the unique needs of these displaced individuals highlight the limitations of – and potential for – digital identity” — World Economic Forum, 2018

Climate change is said to displace millions of people, and the so-called fourth industrial revolution will provide a way to document and aid these “climate refugees” with digital identity.

A WEF Agenda blog post by University of London researcher Maram Ahmed from June, 2019, says that “Climate-related displacement and migration is set to be the greatest challenge of our era.”

Another post by Kyodo News writer Tetsuji Ida from June, 2021 claims that “climate refugees are the world’s forgotten victims.”

Similarly, a WEF white paper on digital identity from January, 2018 states that “sixty-five million individuals – more than at any other time in history – are displaced today due to conflict, drought, famine and other factors.”

Therefore, “The current refugee crisis and the unique needs of these displaced individuals highlight the limitations of – and potential for – digital identity.”

WEF blog contributor Dakota Gruener, who previously worked for the Gates-backed GAVI vaccine alliance (launched at WEF 2000) before moving over to leadership roles at ID2020, co-wrote a story in 2019 saying that digital identity could help “cope with the challenges of mass internal migration” due to the climate change crisis that “has forced many Bangladeshis into seasonal migration.”

GAVI is a founding partner of ID2020, and ID2020 is the group behind the Good Health Pass Collective, which is a project dedicated to bringing about digital identity through “vaccine passports” — a term they despise for the work that they do.

Migrating from climate to COVID, the push for digital identity was accelerated by the adoption of vaccine passports.

Vaccine Passports Are a Form of Digital ID

Vaccines passports by their very nature serve as a form of digital identity.

The World Economic Forum recognized this in its February, 2022 report, Advancing Digital Agency: The Power of Data Intermediaries, which stated:

“The COVID 19 pandemic has led to a heightened focus on the power of medical data, specifically so-called vaccine passports.

“These passports by nature serve as a form of digital identity.”

We have already seen the real-world effect of vaccine passports on a global scale.

They did nothing to prevent the spread of COVID-19 as the so-called vaccines themselves had never been proven to prevent transmission, and Pfizer recently admitted in front of the European Parliament that they were never even tested for preventing transmission.

The World Health Organization said in August, 2021 that vaccine passports “may increase the risk of disease spread” for this very reason.

What was really going on was that COVID passport mandates were fueling authoritarian social credit systems through digital identity schemes.

As a result, citizens all over the world began to rise up against their governments’ tyrannical mandates and restrictions that had nothing to do with public health and everything to do with control.

Vaccine passports laid the foundation for widespread digital identity adoption.

Digital identity schemes are now laying the foundation for a global system of social credit tied to financial institutions.

Central Bank Digital Currencies as a Means to Introduce Digital ID

The heads of both the American Federal Reserve and the European Central Bank recently confirmed Central Bank Digital Currencies (CBDC), should they go forward, would not be anonymous, paving yet another path for all-encompassing digital identity schemes.

“Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity” — Bank for International Settlements, Annual Economic Report, 2021

With respect to an American CBDC rollout, Federal Reserve Chairman Jerome Powell told an international banking panel in September, 2022 that it would have to be “identity verified” and that “it would not be anonymous. It would not be an anonymous bearer instrument.”

In the same vein as her American counterpart, European Central Bank president Christine Lagarde also acknowledged that a digital euro would not be anonymous.

“In terms of anonymity, there would not be complete anonymity as there is with bank notes, for instance, but there would be a limited level of disclosure and certainly not at the central bank level.”

In the absence of complete anonymity, a digital identity system would need to be in place.

“The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement” — Bank for International Settlements, Annual Economic Report, 2021

According to the Bank for International Settlements (BIS) annual economic report for 2021, “The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement.”

This digital identity, according to the BIS, would draw on “information from national registries and from other public and private sources, such as education certificates, tax and benefits records, property registries, etc.”

“Gradual obsolescence of paper currency” is “characteristic of a well-designed CBDC” — World Economic Forum Agenda, 2017

Ultimately, a CBDC linked with digital ID could allow governments and corporations to put permissions on what you can buy with your own money, including expiration dates on when you can spend it.

Once digital ID and CBDC reach a certain level of acceptance and adoption by the general public, the option to go back to physical means can be quietly eliminated with little-to-no pushback.

In fact, a WEF Agenda blog post from September, 2017 lists the “gradual obsolescence of paper currency” as being “characteristic of a well-designed CBDC.”

Leveraging Cyberattacks to Push for Digital ID

On September 22, 2022 Australian telecoms company Optus alerted its customers of a cyberattack that compromised the identities of at least 1.2 million people.

Responding to the Optus hack a week later on September 29, the Australian Strategic Policy Institute (ASPI) think tank recommended “introducing innovative approaches that allow companies to verify customers’ identities without collecting or storing their personal information.”

“What more could be done to reduce the risk of such breaches occurring in the first place? […] One such solution that already exists is the Australian Digital Identity system” — Australian Strategic Policy Institute, September, 2022

“One such solution that already exists,” according to the Australian think tank, “is the Australian Digital Identity system, to which the government committed more than $250 million in funding in the 2020–21 budget. Customers sign up with an accredited identity service provider, such as myGovID, which verifies their identities against official government sources.”

The Australian government is fully behind the idea of implementing digital identity.

Using the Optus cyberattack as a jumping-off point, the Australian Financial Review reported that Australian Finance Minister Katy Gallagher “called together all the digital ministers to kick-start the rollout of a national identity system amid calls for the government to build a new technology infrastructure that would reduce the risk of identity theft.”

“Digital ID for me is a very big part of the future […] Inevitably, governments are going to move in this direction — absolutely, inevitably” — Tony Blair, Cyber Polygon, 2020

Speaking at the WEF-backed, Russian-based Cyber Polygon 2020 cybersecurity training exercise, former British Prime Minister Tony Blair stated with confidence that governments are “absolutely, inevitably” moving in the direction of digital identity adoption.

In his talk, Blair didn’t make the case for why having a digital identity was actually necessary to prevent a cyber pandemic, but rather that digital identities would be an inevitable part of the digital ecosystem, and so governments should work with technology companies to protect and regulate their use.

“Digital ID for me is a very big part of the future,” said Blair.

“Inevitably, governments are going to move in this direction — absolutely, inevitably,” he added.

“And so what I think’s most important is that we from the political side wake-up to the potential of technology and engage with the changemakers inventing the technology, so that we understand it and can regulate it sensibly and not stupidly.”

Cybersecurity is yet another means by which governments and unelected globalists are pushing for digital identity schemes.

And with the coming metaverse, avatars are set to become the embodiment of digital identity.

The types of experiences users will have in the metaverse, where they can go, what they can purchase, and other levels of access, will be directly related to their digital identity.

Convenience as a Digital ID Selling Point

Convenience is a major selling point for digital identity rollouts among public and private entities.

One of the most ambitious countries in this regard is Ukraine.

“We have to make a product that is so convenient that a person will be able to disrupt their stereotypes, to breakthrough from their fears, and start using a government-made application” — Mykhailo Fedorov, Ukraine’s Minister of Digital Transformation

In April, 2021 Ukraine’s Minister of Digital Transformation Mykhailo Fedorov told the World Economic Forum that his government’s goal was to create a digital ID system that within three years would make Ukraine the most convenient State in the world by operating like a digital service provider.

“The pandemic has accelerated our progress,” he said. “First of all, people are really now demanding digital, online services. People have no choice but to trust technology. We see what kind of business is developing, and this business is influencing the development of our services.”

Fedorov believes that if you give the people an overwhelming amount of convenience that is accompanied by strong cybersecurity, then they will have no choice but to trust the technology.

“We believe that we have to make the best product possible, a high quality product, a product that is so convenient that a person will be able to disrupt their stereotypes, to breakthrough from their fears, and start using a government-made application,” said Fedorov.

“When we allow a person to register a business in three clicks; when we allow them to pay their taxes in two clicks — no matter how skeptical a person is about the technology, they will start using our services.”

“Our goal is to enable all life situations with this digital ID,” he added.

“Our goal is to enable all life situations with this digital ID” — Mykhailo Fedorov, Ukraine’s Minister of Digital Transformation

The elites are betting on convenience and the illusion of choice to help them achieve mass acceptance and trust.

The lengths to which public and private entities will go to in justifying their digital identity rollouts are seemingly never ending.

Unelected globalists and governments alike are claiming digital identity schemes are necessary to mitigate the effects of COVID, climate change, and cyberattacks, all while championing the elimination of anonymous transactions in favor of a fully traceable, fully interoperable, and fully programmable CBDC.

Ultimately, digital identity schemes can give governments and corporations the power to manipulate, coerce, or incentivize changes in human behavior while eliminating individual agency, autonomy, and anonymity under a system of social credit.