India’s digital ID architect tells an IMF panel that everybody should have a digital ID, a bank account, and a smartphone as they are the “tools of the New World” for digital public infrastructure.

Speaking on a panel about Digital Public Infrastructure (DPI) during the International Monetary Fund’s (IMF) Spring Meetings on April 14, Infosys co-founder and ex-chair of the Unique Identification Authority of India (UIDAI), Nandan Nilekani, said that in order for nations to build out their DPI, they will need three things.

“If you think, ‘what are the tools of the New World?‘ — Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone,” said Nilekani.

“Then, anything can be done. Everything else is built on that.”

Moderator and CNN International anchor Julia Chatterley concurred with Nilekani, saying:

“The three basic things: a smartphone, a bank account, and a digital ID — that’s where every nation has to begin.”

“Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone” — Nandan Nilekani, IMF Spring Meetings, 2023

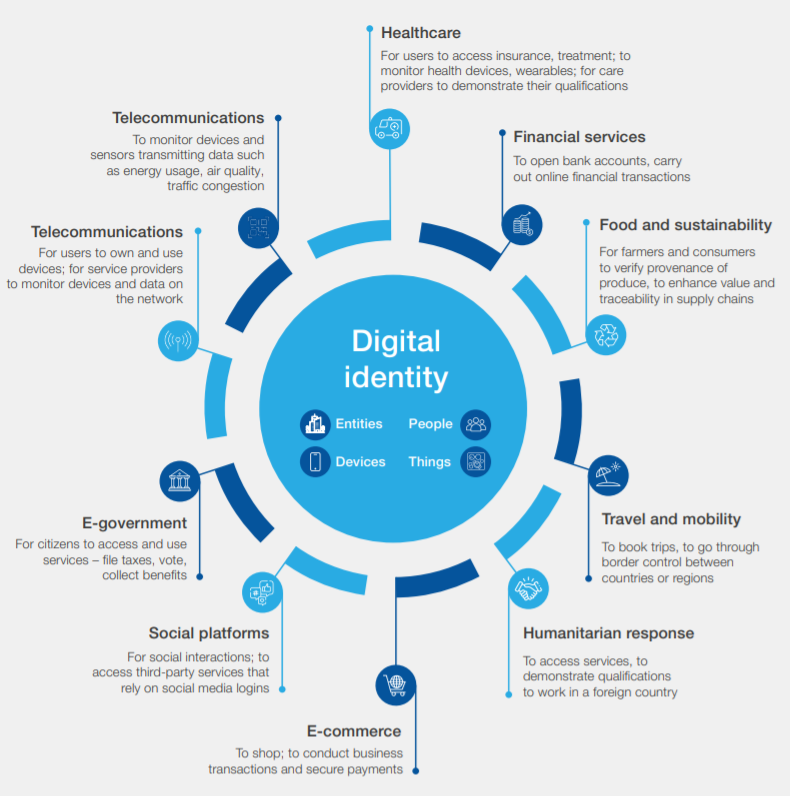

A digital identity encompasses just about everything that makes you unique in the digital realm, including your behavior.

It is a system that can consolidate all of your most personal intimate data, such as which websites you visit, your online purchases, health records, and what you post on social media.

Digital identity schemes can also be used by public and private entities to determine what products, services, and information are available to you, and they can certainly be used by those same entities to deny you that access.

According to a World Economic Forum (WEF) digital identity insight report from 2018, “This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us.”

Digital identity is also key to Central Bank Digital Currency (CBDC) rollouts.

According to the Bank for International Settlements (BIS) Annual Economic Report 2021, “Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity.”

Additionally, “The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement.”

This means that CBDCs, by design, do not allow for anonymous transactions as they require a digital ID to operate.

In addition to the absence of complete transactional anonymity, programmability is a key feature that separates physical cash from CBDC.

Speaking at a high-level roundtable on CBDC in Washington, DC in October 2022, IMF deputy managing director and former People’s Bank of China (PBoC) deputy governor Bo Li said:

“CBDC can allow government agencies and private sector players to program — to create smart contracts — to allow targeted policy functions. For example, welfare payment; for example, consumption coupons; for example, food stamps,” said Li.

“By programming CBDC, those [sic] money can be precisely targeted for what kind of people can own and what kind of use this money can be utilized,” he added.

Ultimately, a CBDC linked with digital ID could allow governments and corporations to put permissions on what you can buy with your own money, including expiration dates on when you can spend it.

Bank of Russia deputy governor Alexey Zabotkin gave a real world example of what CBDC programmability could look like when he spoke at the annual cybersecurity training exercise Cyber Polygon back in 2021.

There, Zabotkin explained:

“This [digital ruble] will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency.

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food, for example.

“That would be a useful functionality for a customer, and of course you can come up with hundreds of other similar use cases.”

“In the coming years, starting with financial services, and later on in other areas, individuals will be able to use their own data to get a loan, to get better financial services, to get better healthcare, to get better jobs” — Nandan Nilekani, G20 Development Working Group, 2022

Last year, Nilekani — the man credited with building India’s vast Aadhaar digital ID scheme — told the Group of Twenty (G20) Development Working Group that it should look at different ways of harnessing data on social and economic activities to advance the UN’s Agenda 2030 sustainable development goals.

“Today we live in a society which is increasingly digitized, and every aspect of our life has digital technology in it,” said Nilekani in December 2022.

“We find that this is generating vast amounts of data about our social and economic activities, and we should look at different ways to harness this data for development goals,” he added.

The godfather of India’s digital ID scheme would go on to say that “In the coming years, starting with financial services, and later on in other areas, individuals will be able to use their own data to get a loan, to get better financial services, to get better healthcare, to get better jobs.”

In addition to spearheading India’s digital ID scheme during his tenure as chair of the UIDAI from 2009-2014 and being a co-founder of tech giant Infosys, Nilekani has held high-level positions at Reuters, the World Economic Forum, and the World Bank Group’s Identification for Development (ID4D) Initiative.