The continued fallout of the Covid-19 pandemic and widespread economic downturns may have punctuated much of the early 2020s, but thanks to innovations in the world of generative AI, we may soon be set for the unlikely return of the ‘Roaring 20s’.

At least, these are the thoughts of leading economist Ed Yardeni, of Yardeni Research, who wrote in a May newsletter to subscribers that generative AI “may be the event that re-launches the Roaring 2020s.”

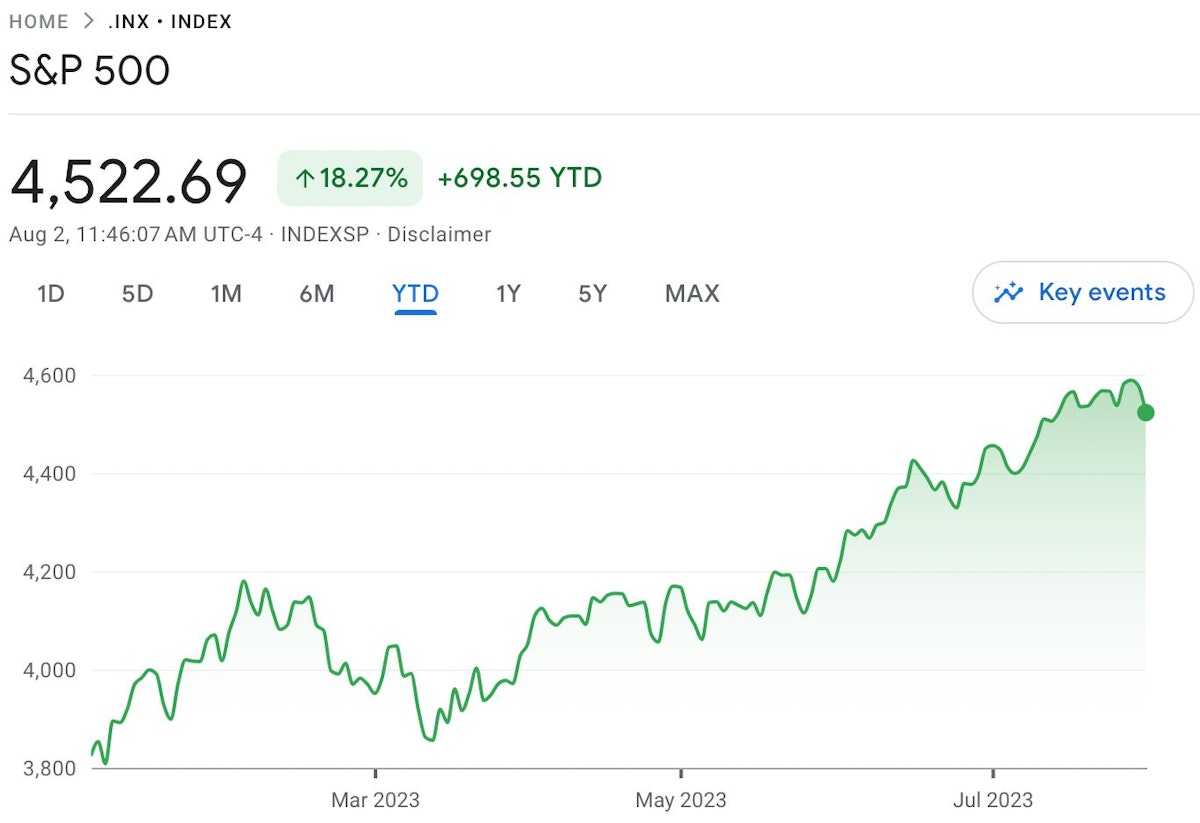

It may be hard to anticipate the emergence of a Wall Street boom period given the economic backdrop that investors have been contending with. As inflation rates continue to cause issues in the cost of living for global populations, the prospect of a recession still lingers. Despite this, it’s important to note that indexes like the S&P 500 have been remarkably quick to recapture their significant losses in the wake of 2022’s tech stock sell-offs.

In 2023 alone, we’ve seen the S&P 500 grow more than 18% off the back of innovations in generative AI and their ability to capture the imagination of investors.

Could the cautious optimism delivered by generative AI so far in 2023 be sustainable? And is it possible for investors to buy into the market despite significant trading volumes entering the market? Let’s take a deeper look at the AI phenomenon and how it may develop:

Generative AI Gears up for a Strong Second-Quarter

The S&P 500 isn’t the only tech-heavy index that’s experienced a strong resurgence amidst 2023’s generative AI boom. The Nasdaq composite has grown almost 35%since the beginning of the year and is showing little signs of abating.

“Heading into the second half of 2023, we see a much broader tech rally ahead as investors further digest the ramifications of this $800bn AI spending wave on the horizon and what this means for the software, chip, hardware, and tech ecosystem over the next year,” explained Dan Ives, managing director at Wedbush Securities.

“We view this as a ‘1995 internet moment’… not a ‘1999 dot bubble moment’. We estimate for 2024 that AI could comprise up to 8% to 10% of overall IT budgets v 1% in 2023,” Ives added.

This strongly indicates that the generative AI boom that we witnessed in early 2023 is just the beginning, and that seismic price rallies are sustainable enough to transcend the perception that they exist in a bubble.

Crucially, leading tech firms like Microsoft, Alphabet, and Adobe are working to realize the potential of this surge in investor interest in AI. Microsoft, for instance, has introduced a $30 subscription service focused on uniting generative AI with Microsoft 365 services.

The general feeling among financial experts is that generative AI could also be the tide that raises all boats. Maxim Manturov, head of investment advice at Freedom Finance Europe, suggests that generative AI may even be capable of reviving interest in ailing metaverse projects.

“Coupled with AI, the metaverse could become a major force in the coming years. It could revolutionize the way we learn, work, and play,” Manturov notes. “However, it’s important to remember that the meta is still in the early stages of development. It is too early to say for sure what the future holds for the metaverse.”

So, how can investors embrace the age of generative AI? Are leading AI-facing stocks overvalued in comparison to small-cap opportunities? While it’s impossible to anticipate which firms will come out of the generative AI boom thriving, it’s certainly worth exploring small-cap options with the potential to grow exponentially should the ‘Roaring 20s’ truly come to fruition. Notable small-cap AI stocks include:

1. UiPath (NYSE: PATH)

When looking at UiPath’s 2023 performance, you’d be forgiven for thinking that it’s another example of a wildly successful generative AI stock. However, zooming out a little further shows that the stock is still over 78% underwater and steadily recapturing ground based on the intelligent adoption of new AI technologies.

Recently, UiPath announced an expanded suite of generative AI technologies and tools offering more support for Amazon’s Falcon Large Language Model (LLM), OpenAI, Azure OpenAI, and Google’s Vertex connector.

These prospects, coupled with UiPath’s relatively modest market cap of just under $10 billion illustrate a forward-focused firm with plenty of room for growth.

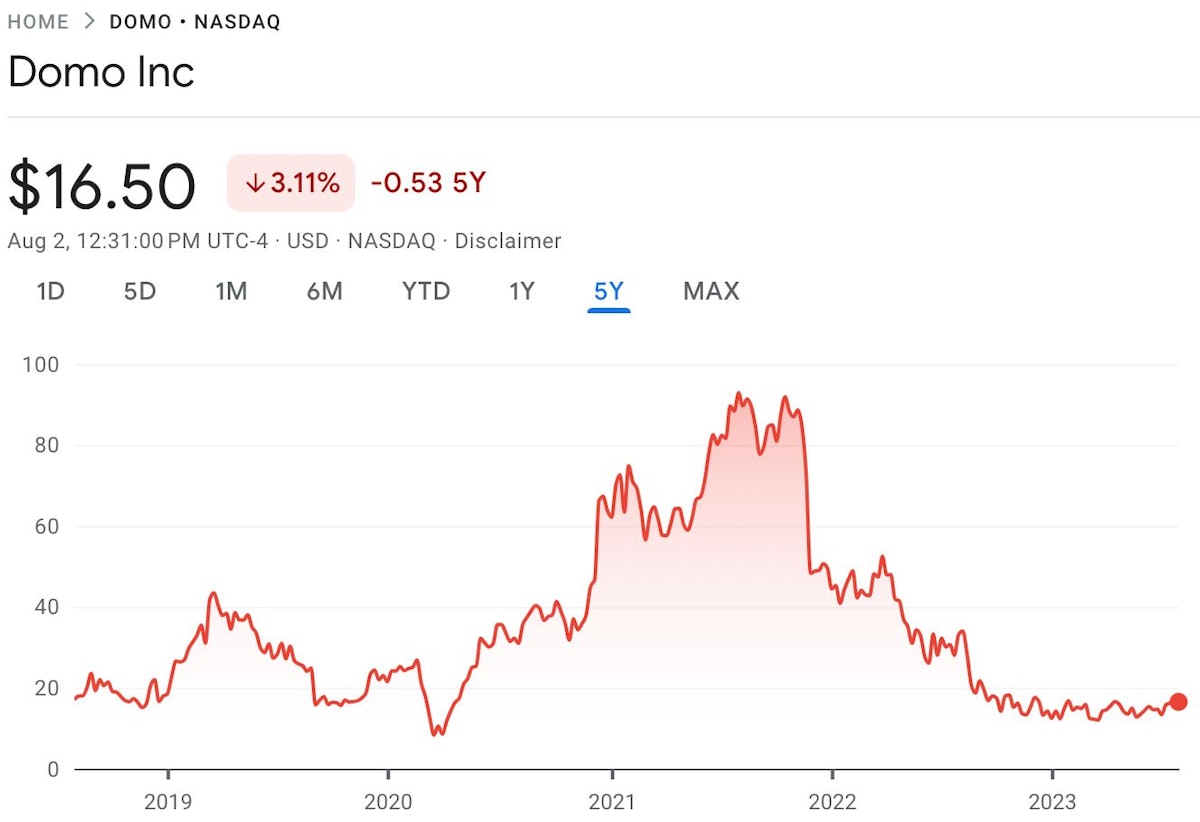

2. Domo Inc. (NASDAQ: DOMO)

With a market capitalization of around $600 million, Domo is certainly a stock that’s yet to be fully swept away by the generative AI force.

Operating as a cloud software company delivering business intelligence tools and data visualization solutions, Domo’s AI Service Layer helps to simplify the process of managing, deploying, and enhancing AI and machine learning models, as well as Large Language Models (LLMs) for data experiences.

Offering generative AI and natural language processing for text generation and SQL queries to audio transcribing and text translating, Domo may prove to be a leading resource in B2B generative AI services.

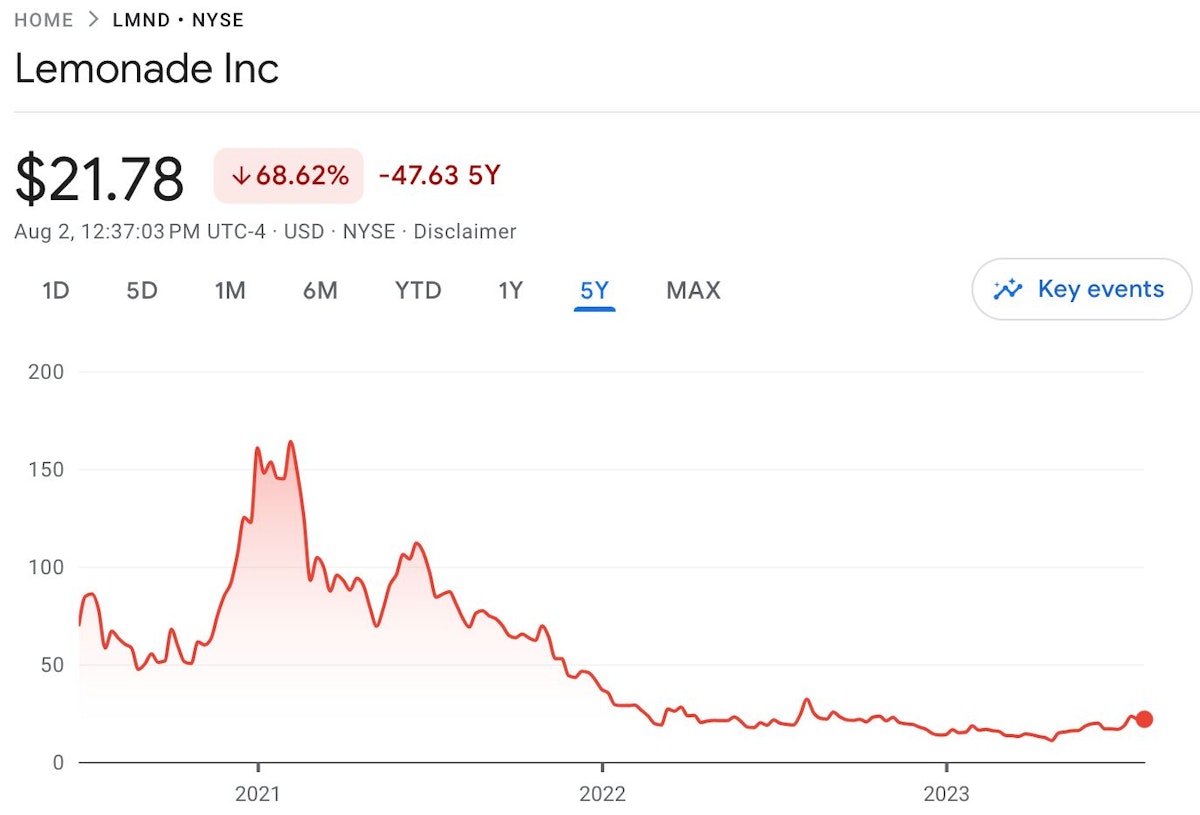

3. Lemonade Inc. (NYSE: LMND)

Lemonade is a digital insurance company that utilizes AI and behavioral economics to offer a vast range of insurance services for customers in the US.

In a May shareholder letter, the firm announced that it anticipates leveraging generative AI to enhance as many as 100 of its business processes. With strong roots in artificial intelligence services, Lemonade’s $1.5 billion market cap may have room for growth as economic headwinds weaken.

For investors looking for small-cap market opportunities in generative AI, sufficient research must be conducted before adding a new firm as a long hold. The market is still in its fledgling phase, and new challengers are likely to emerge at a rapid pace.

With this in mind, it’s fair to expect volatility throughout generative AI stocks over the coming years. However, likely, the stocks that emerge as market leaders in their respective sectors will see significant growth as the AI boom continues to win new supporters.

This article was originally published by Dmytro Spilka on Hackernoon.