Neobanks and fintech solutions hit the US market more than a decade ago, acting as a catalyst for a financial digital revolution. A recent survey from Visa found that 87% of American consumers are already utilizing various forms of open banking to connect their financial accounts with third-party services.

Yet while it’s estimated that only 5% of neobanks worldwide have reached profitability, areas within the industry, including embedded finance, have clearly shown the value of its innovation. McKinsey currently places the US market value of embedded finance at $20 billion.

Put simply, embedded finance refers to the process of integration of financial services into non-financial offerings. The trend has seen brand and tech platforms turn to banks to help create tailored offerings that cater to their user bases, embedded seamlessly in their online experiences. An example of this in action could be Uber helping its drivers earn rewards when paying for fuel with a new debit Mastercard product.

However, this is just one of the areas in fintech that continues to grow, in addition to payment processing, peer-to-peer lending, fraud detection, AI and blockchain technology, and more.

According to Fortune Business Insights, the fintech market globally is poised to reach $1,152 billion by 2032. The industry’s compounded annual growth is expected to be a startling 16.5%.

The challenge of creating finance products

When it comes to implementation, obstacles in fintech remain. For example in the case of embedded finance products, banks relinquish a direct relationship with users, as the customer in these scenarios is the company provider in the middle.

This means that banks need to ensure that close attention to detail is paid during product development to avoid user experience problems.

Further, digital finance products fall under more stringent regulatory standards than other industries, which means they can be more costly to develop than other types of digital products. Cybercrime is also a very present risk for any digital product that handles financial information, which means that off-the-shelf or low-code solutions that usually help to speed up the development process can’t be leveraged in finance.

In summary, fintech solutions have the potential to be highly profitable. However, the sensitive nature of financial data and stringent regulatory standards mean that digital products take time and money to develop to meet industry benchmarks and provide a seamless, effective experience for users.

Banks and financial institutions are increasingly partnering up with software experts and project management teams to build award-winning digital products that realize new growth opportunities within this burgeoning market.

10Pearls: Driving excellence across digital financial services

As the demand for digital finance products grows with both business consumers and individuals, expectations are also higher. 10Pearls has been working with a range of partners to develop high-quality fintech products for a number of years, offering deep expertise in both software design and corporate business needs.

Founded in 2004 by Imran Aftab and Zeeshan Aftab, the agency boasts a passionate team of financial consultants and fintech software developers who are used to working on a range of projects, whether it’s creating a new solution from scratch or working to scale up existing offerings in new ways.

To give an example, 10Pearls recently partnered up with PayPal to reimagine the user experience for the financial company’s small business customers. During the process, the agency met with small businesses from across the US to understand their pain points and banking needs, worked with PayPal to develop wireframes and design directions, and then aligned with both parties to closely manage the product launch to ensure a consistent experience.

Banks and financial institutions face enormous pressure to be constantly innovating to stay ahead of other players and maintain their share of this competitive market. There are also huge opportunities to create entirely new products for underserved communities in order to drive financial inclusion and cater to new business customers.

By working with a trusted partners in software development, the financial sector can dive into deep expertise to get projects off the ground quickly without compromising on quality or standards.

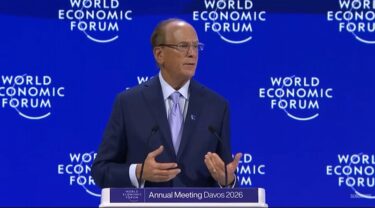

Featured photo of 10Pearls CEO Imran Aftab

This article includes a client of an Espacio portfolio company