NVIDIA, best known for its GPUs that serve as the foundation for the AI boom, is preparing to launch its latest technology for humanoid robots, Jetson Thor, in the first half of this year, adding to the positive news for the industry that continues to move from strength to strength.

According to a recent report, the robotics market is expected to reach an expected value of $169.8 billion by 2032 thanks to economies of scale and the development of user-friendly and adaptable systems.

The success of the industry, long one of the most stable thanks to its extremely wide range of practical use cases that span everything from space exploration and surgery to manufacturing and logistics, can be attributed in part to its ability to harness the benefits of complimentary tech innovations.

For example, California’s Clone Robotics hit headlines this week after releasing a video of its full-body Protoclone humanoid robot to showcase the full polymer skeleton consisting of all 206 bones in action. Meanwhile, Jeong Jae Wie of Hanyang University in South Korea captured attention this past December thanks to his team’s groundbreaking advances in microbotics. Although still in development, these swarms of tiny magnetic robots with Herculean strength could one day be used to deliver minimally invasive healthcare treatments.

The above taken into account, the robotics story wouldn’t be complete without considering the extremely important role of AI and computing technologies. These two disciplines have long developed their capabilities in tandem.

Robots rely on computer systems to see, think, react, and learn to perform tasks within their environments. Advances in autonomous AI, vision and sensor technology push the capabilities of robotics forward.

It’s important to note the symbiotic relationship here. The robotics industry ensures that advances in AI and machine learning are usable and useful in the physical world, driving growth and adoption. While advances in AI have captured the attention of investors for much of 2024, the robotic industry is set to hit even more impressive heights over the next few years.

Here, Sumedh Nadendla, investment lead at Los Angeles-based Pacific Alliance Ventures, is one global investor betting on robotics for the future.

Robotics continues to hold investor confidence

The robotics industry hasn’t always held the most buzz, however it’s long been able to maintain investor interest. The last five years saw $90B invested in startups across the global robotics space, representing roughly 10 percent of overall VC investments.

And although breakthroughs from the likes of Clone Robotics capture the public imagination,

industrial use cases and end-to-end solutions such as pick-and-place robots in fulfillment centers, or autonomous vehicles moving crops on a farm or in a nursery, have helped to attract the attention of investors.

When it comes to practical, real-world adoption of robotic solutions, South Korea leads the pack. According to the World Robotics R&D Programs 2025 report, the country is already the top adopter of robotics in industrial settings, with 1,012 robots per 10,000 employees.

This has been fueled in part thanks to South Korea’s 4th Basic Plan on Intelligent Robots, that aims to drive progress with the Fourth Industrial Revolution and address the economic impact of the country’s falling birth rates with robotics.

The Shinsegae / Emart Group, one of the largest conglomerates in South Korea, is playing an active role in part thanks to its corporate venture arm, Pacific Alliance Ventures, where Nadendla acts as Investment lead.

Pacific Alliance Ventures in fact was announced as an investor in the $38 million Series B funding round for Butlr, an MIT Media Lab spinout with a patented combination of body heat sensing technology and machine learning in the form of sensors that magnetically mount to the wall or ceiling and provide insight into how a building’s interior space is used for working and living.

The firm has also invested in Trace Machina, an early stage startup building advanced simulation software that enables developers to test updates in a more realistic simulated environment.

The path from Ivy League to global investor

Sumedh Nadendla’s position as an influential investment lead is the result of a lifelong commitment to tech and innovation. He took a particularly early interest in distributed and networked systems, robotics and AI, which proved to be prescient given the explosive growth in both industries and led to his role at Pacific Alliance Ventures.

Sumedh graduated with a Bachelor of Technology from one of the best research institutions in India. This provided the foundation for Sumedh to gain an early lead in the AI field through his work as a software engineer at Arista Networks.

As an engineering undergraduate, Sumedh took an active interest in research, which saw five of his papers accepted for publication in IEEE and Springer journals on topics ranging from automation, IoT and machine learning. This paved the way for him to secure a position as a software engineer at Arista Networks in 2019.

It was during this that Sumedh made important contributions to the advancement of networking and distributed systems. He was part of the product release and test team that enabled multiple GPUs to communicate without dropping a single packet of data. The approach, known as lossless fabric, is what is today used by clouds like Azure and Google Cloud Platform to connect supercomputer clusters and train OpenAI models.

After this, Sumedh completed his Master’s degree in Management Science and Engineering at the renowned Columbia University in New York. Before being appointed as Investment Lead at Pacific Alliance Ventures in 2023, he worked as an investment associate at MXV Capital, a fund founded by Mark Ghermezian, founder of popular campaign management tool Braze and member of the Triple555 family, and as a consulting team member for UNDP’s Crisis Bureau.

The UNDP helps countries anticipate, prevent and respond to crises, and as a part of this team, Sumedh and team developed approaches aimed at sustaining the Humanitarian-Development-Peace nexus across 46 Sub-Saharan African countries.

Throughout, Sumedh has worked to hone evolving startup growth strategies and his ability to identify disruptive innovations in order to support founders with the most promising solutions and invest in early-stage enterprise tech and consumer segment startups. Further, work at Pacific Alliance Ventures is supported by his research from Columbia University which focused on non-cooperative game theory with an emphasis on market entry games, technological adoption models, and the nature of disruptive changes.

Sumedh has spoken about the key attributes needed to build a successful, lean startup. Here, he recognizes the precarious nature of these specific business entities which builds the case for bringing Minimum Viable Products to market and iterating from there.

However, he also understands that there is no “One Size Fits All” solution to starting a successful venture. In addition, he is deeply passionate about technology, especially in the realms of operating systems, compilers, networking, AI/ML and databases.

Following a particularly early interest in robotics and AI combined with deep knowledge of the investment landscape, Nadendla is poised to bring these highly complementary technologies to market.

Why it pays to be bullish on robotics

DeepSeek dominated tech headlines last month thanks to the release of its GenAI model, which is comparable to the likes of ChatGPT but with an LLM built at a fraction of the cost.

In the years ahead, lower-cost AI models are set to become much more common as the LLM inference cost drops. For an LLM of equivalent performance, the cost is decreasing 10x every year.

This is set to have huge implications for the robotics industry. Although robots that integrate the latest AI breakthroughs have incredible potential, the high associated costs mean they aren’t always viable to adapt at scale within industries.

With a thesis on marginal revenue, this is a concept Nadendla is familiar with. As AI becomes more cost-efficient, its use in robotics becomes more viable thanks to fundamental economic feasibility principles.

To summarise, as marginal costs decrease in robotics it becomes feasible to apply them to a higher number of jobs or tasks.

For example, GPUs are helping to drive further efficiencies and overcome many of the optimization problems associated with complex autonomous robotic solutions. These often demand very high amounts of processing power to support a combination of AI tools such as neural networks for vision, such as the solution from Trace Machina, SLAM for mapping, and large-scale solvers for complicated optimal control problems. GPUs will play an important role here.

Yet the lack of a good robotics operating system that allows for higher level applications and the time needed to train humanoid robots are additional hurdles that the industry will need to address to bring costs down further and improve feasibility.

Still, the combined power of AI and robotics promises to drive adoption across industries and in new use cases with early demand already present in sectors like security and surveillance.

Turning these innovations into viable business models that contribute to overall growth hinges on access to investors like Sumedh Nadendla, whose expertise in deep tech combined with business economics brings more companies to market.

Robotics as a growth lever

While the tech sector is constantly evolving, the field of robotics remains a constant source of growth. Robotics helps to close the gap between conceptual technologies and viable applications, and turn breakthrough innovations into solutions that can be adopted by industries at scale.

The rise of cost-effective AI models is set to drive the adoption of robotics to new highs in 2025.

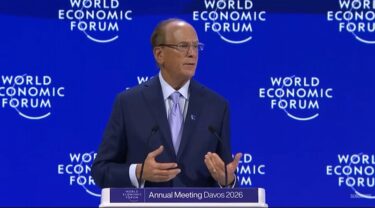

Article’s featured photo of Sumedh Nadendla