The WEF-backed Cyber Polygon 2021 cybersecurity training exercise report published today concludes that cryptocurrencies are very volatile and that Central Bank Digital Currencies (CBDCs) and stablecoins will keep the monetary system stable.

Exactly four months after Cyber Polygon 2021 took place, the results of the cyber pandemic prepping and cybersecurity preparedness exercise have been published.

“[CBDC and stablecoins] are the potential drivers for the development of the commercial banking sector. Cryptocurrency is very volatile, but it does generate a lot of public interest in the concept of digital currency” — Cyber Polygon 2021 report

According to the report:

“Electronic money falls into three main categories: central bank digital currencies (CBDC), stablecoins and cryptocurrencies.

“The first two are the potential drivers for the development of the commercial banking sector. Cryptocurrency is very volatile, but it does generate a lot of public interest in the concept of digital currency.

“The task of central banks is to keep the monetary system stable. In pursuit of this, central banks must be at the heart of the changes in the financial sector, they must broaden the functionality of money and of the economy, which is becoming increasingly digitized.”

Readers of The Sociable will recall our coverage of the event in July, which highlighted the demonization of cryptocurrencies as a major theme emerging from Cyber Polygon 2021, alongside the centralization of power and surveillance.

Today, the Cyber Polygon 2021 report doubled-down on the crusade against crypto.

“Central banks must be at the heart of the changes in the financial sector” — Cyber Polygon 2021 report

“The rapid adoption and decentralized nature of digital currencies pose unprecedented challenges for financial and tax authorities, capital market regulators and the business community” — Matthew Blake, WEF, Cyber Polygon 2021 report

The unelected globalists at the World Economic Forum and their partners wish to ensure that central banks remain stewards over the economy.

Decentralized cryptocurrencies pose a threat to that agenda.

According to WEF Head of Financial and Monetary System Initiatives Matthew Blake:

“The rapid adoption and decentralized nature of digital currencies pose unprecedented challenges for financial and tax authorities, capital market regulators and the business community.”

“We applaud the efforts by the WEF in actively researching digital currencies […] to ensure that central banks can maintain their role as stewards of the economy” — WEF Agenda, 2020

When the WEF announced the launch of the “Global Consortium for Digital Currency Governance” in January, 2020, ConsenSys Founder Joseph Lubin praised the WEF for helping to ensure that central banks could “maintain their role as stewards of the economy.”

“New technologies, like blockchain, have helped catalyze a revolution in the mechanics of money,” said Lubin.

“We applaud the efforts by the WEF in actively researching digital currencies, including those that are blockchain-based, as a means to foster innovation but also ensure that central banks can maintain their role as stewards of the economy,” he added.

“[Digital ruble] will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency” — Alexey Zabotkin, Cyber Polygon 2021

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food” — Alexey Zabotkin, Cyber Polygon 2021

Governments and central banks don’t like the idea that citizens can choose to participate in an alternative economic system. They prefer centralized control and surveillance.

Bank of Russia, for example, is exploring a permission-based digital ruble that can restrict what a person can buy.

Speaking at Cyber Polygon 2021, Bank of Russia Deputy Governor Alexey Zabotkin said the digital ruble “will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency.”

The Russian central bank authority said that parents could give the digital currency to their children with certain restrictions, such as blocking them from buying junk food.

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food, for example.

“That would be a useful functionality for a customer, and of course you can come up with hundreds of other similar use cases,” Zabotkin added.

“The Bank of Russia will maintain the centralized ledger on the Bank of Russia’s technological platform, and all transactions will be recorded on this ledger” — Alexey Zabotkin, Cyber Polygon 2021

Not only can Central Bank Digital Currencies be programmed with permissions for what you are allowed to buy, but the goal is to keep a record of every single transaction ever made.

As Zabotkin said at Cyber Polygon 2021, “The Bank of Russia will maintain the centralized ledger on the Bank of Russia’s technological platform, and all transactions will be recorded on this ledger.”

The WEF and partners are pushing for centralized digital currencies that are easy to control and regulate.

However, “Anytime you have a centralized financial application, what you have is the ability to censor,” according to CoinShares CSO Meltem Demirors.

“Bitcoin in its purest form is a form of monetary peaceful protest” — Meltem Demirors, 2021

“It’s very important for a healthy, free democratic society that people have the ability to transact financially with freedom” — Meltem Demirors, 2021

Speaking at a WEF cryptocurrency panel in September, 2021, Demirors told the unelected globalists that cryptocurrencies like Bitcoin were important tools for preserving freedom and human dignity.

“Bitcoin in its purest form is a form of monetary peaceful protest,” she said.

Highlighting that “totalitarian governments are on the rise around the world,” Demirors explained that crypto was a way for people to circumvent censorship while giving citizens the option “to participate in an alternative economic system that has different rules than the one issued by their government.”

“We can choose for the first time to exit the petrodollar system, which has caused so much economic damage, so much social damage, and frankly, more environmental degradation and damage than any other technology” — Meltem Demirors, 2021

“It’s very important for a healthy, free democratic society that people have the ability to transact financially with freedom,” she said.

“We can choose for the first time to exit the petrodollar system, which has caused so much economic damage, so much social damage, and frankly, more environmental degradation and damage than any other technology,” Demirors added.

The Cyber Polygon 2021 report concluded that “digital currencies promote the development of the financial industry, but need regulation to

ensure its stability.”

Cyber Pandemic Preparations

Cyber Polygon 2021 took place on July 9 and simulated a supply chain attack on a corporate ecosystem in real time.

Prior to Cyber Polygon 2021, the WEF released a short video on January 18, 2021 warning about a “cyber attack with COVID-like characteristics” that would “spread faster and further than any biological virus.”

“The only way to stop the exponential propagation of a COVID-like cyber attack threat is to fully disconnect the millions of vulnerable devices from one another and from the internet” — WEF, 2021

According to the video above, “A single day without the internet would cost our economies more than $50 billion, and that’s before considering economic and societal damages should these devices be linked to essential services, such as transports or healthcare.”

Furthermore, “The only way to stop the exponential propagation of a COVID-like cyber attack threat,” according to the WEF, “is to fully disconnect the millions of vulnerable devices from one another and from the internet.”

“We all know, but still pay insufficient attention to, the frightening scenario of a comprehensive cyber attack, which would bring a complete halt to the power supply, transportation, hospital services, our society as a whole” — Klaus Schwab, WEF, 2020

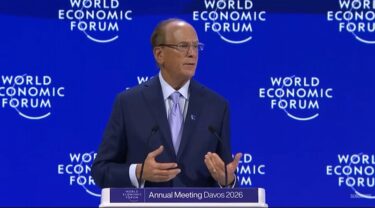

In his opening remarks at Cyber Polygon 2020, World Economic Forum Founder and Executive Chairman Klaus Schwab warned about a coming “cyber pandemic” that would be worse than the current global crisis.

“We all know, but still pay insufficient attention to, the frightening scenario of a comprehensive cyber attack, which would bring a complete halt to the power supply, transportation, hospital services, our society as a whole,” he said.

“The COVID-19 crisis would be seen in this respect as a small disturbance in comparison to a major cyber attack.”

Schwab added that it was “important to use the COVID-19 crisis as a timely opportunity to reflect on the lessons of cybersecurity community to draw and improve our unpreparedness for a potential cyber pandemic.”

“A lack of cybersecurity has become a clear and immediate danger to our society worldwide” — Klaus Schwab, Cyber Polygon 2021

“We need to build IT infrastructures that have digital antibodies built-in inherently to protect themselves” — Klaus Schwab, Cyber Polygon 2021

This year, Schwab opened Cyber Polygon 2021 with another warning:

“A lack of cybersecurity has become a clear and immediate danger to our society worldwide.”

He ended his speech by saying:

“One of the lessons of the COVID-19 pandemic is also the notion of resilience.

“We have to protect ourselves not only against the virus, we also have to develop the ability to withstand a virus attack.

“In other words, masks are not sufficient. We need vaccines to immunize ourselves.

“The same is true for cyberattacks. Here, too, we have to move from simple protection to immunization.

“We need to build IT infrastructures that have digital antibodies built-in inherently to protect themselves.”

Cyber Polygon will be back in 2022 with a specific date to be announced at a later time.

Cyber Polygon furthers great reset agenda of centralized power & surveillance

CyberPeace Institute is mapping & tracking cyberattacks on healthcare for societal impact

A timeline of the great reset agenda: from foundation to Event 201 and the pandemic of 2020