A CBDC linked with digital identity could allow governments & corporations to put permissions on what you can buy with your own money, including when & where you can spend it: perspective

The European Central Bank (ECB) puts out a call to digital identity experts to participate in a workstream that will contribute to its digital euro rulebook for the proposed Central Bank Digital Currency (CBDC).

Participants in the ECB’s workstream “are expected to be leading experts in strong customer authentication (SCA) and identification, including digital identity initiatives, preferably with experience in related regulatory technical standards on SCA and in implementing customer identity and access management solutions.”

Potential candidates are required to respond to the following:

- Provide a proposal for the best possible user experience for the digital euro with regard to identification and authentication in the use cases it covers.

- What existing standards/regulations do you think the digital euro should refer to and/or build on for (i) identification and (ii) authentication?

- Do you think that some of these standards/regulations would need to be adapted to accommodate the digital euro? If so, to what extent? (Please distinguish between identification/onboarding and authentication in your answer.)

- How do you envisage a potential link between the digital euro identification and authentication mechanisms and potential upcoming digital identity initiatives?

According to the ECB, the main objective of the workstream “is to suggest identification and authentication requirements for the digital euro” while the workstream itself “will contribute to the ‘Functional and operational model’ section of the digital euro rulebook.”

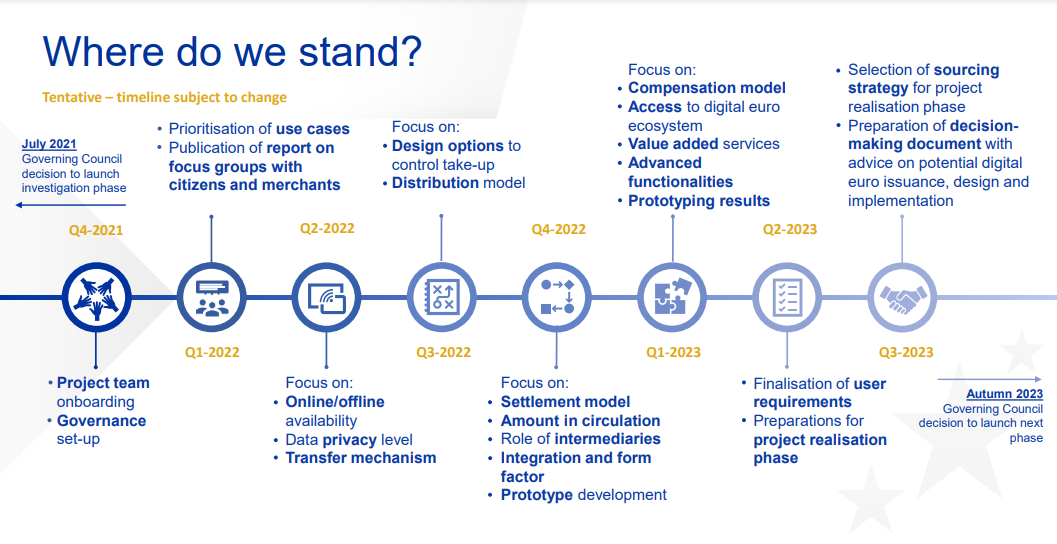

The ECB’s investigation phase into the digital euro began in October, 2021 and is set to conclude in October, 2023 when the central bank “will decide whether to start the process of actually developing it.”

The International Monetary Fund (IMF) is also in the process of creating a CBDC handbook to assist central banks and governments throughout the world in their CBDC rollouts.

Published publicly on April 10, the “IMF Approach to Central Bank Digital Currency Capacity Development” report outlines the IMF’s multi-year strategy for aiding CBDC rollouts, including the development of a living “CBDC Handbook” for monetary authorities to follow.

Chapter 11 “will consider the tradeoff between data use and privacy protection,” including “what data are generated by CBDC transactions and which institutions might have access to it.”

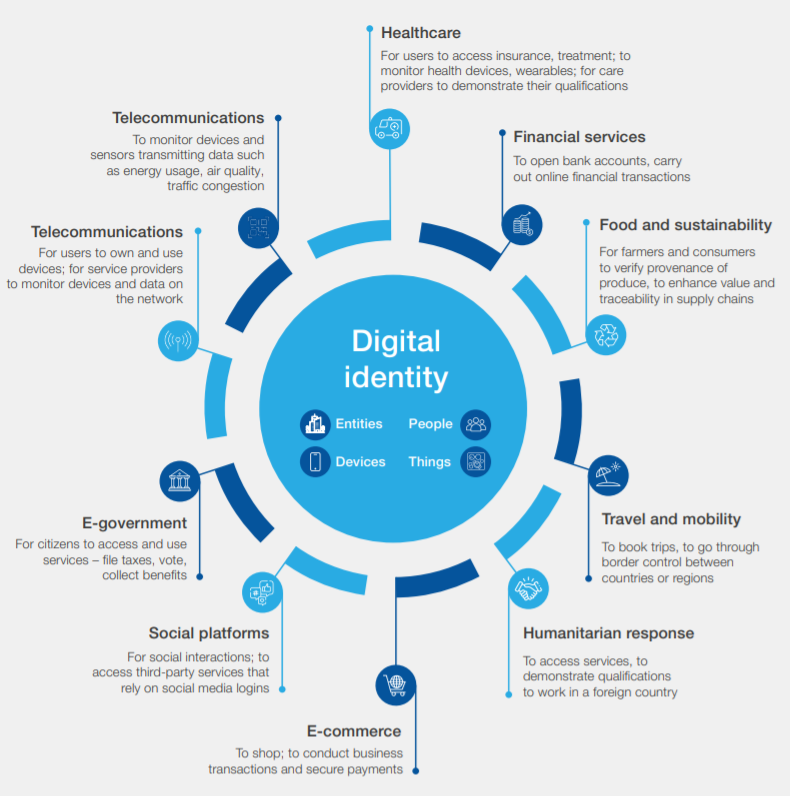

This data will inextricably be linked to a user’s digital identity.

“This digital identity,” according to the World Economic Forum (WEF), “determines what products, services and information we can access – or, conversely, what is closed off to us.”

According to the Bank for International Settlements (BIS) Annual Economic Report 2021:

“Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity.”

Additionally, “The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement.”

Speaking at the BIS Innovation Summit in March, 2023, ECB president Christine Lagarde said that a digital euro would not be as anonymous or as private as cash.

“Is it [digital euro] going to be as private as cash? No,” she said.

“A digital currency will never be as anonymous and as protecting of privacy in many respects as cash, which is why cash will always be around […]A digital currency is an alternative, is another means of payment and will not provide exactly the same level of privacy and anonymity as cash, but will be pretty close in terms of complete neutrality in relation to the data.”

Lagarde also told her fellow panelists that central banks would not be in charge of programming a digital currency, but that commercial banks certainly would.

“For us [central banks], the issuance of a digital currency that would be central bank money would not be programmable — would not be associated with any particular limitation, whether it’s in time, in type of use — that to me would be a voucher. It wouldn’t be a digital currency,” said Lagarde.

“Those who can associate the use of digital currency with programmability would be the intermediaries — would be the commercial banks.”

CDBCs run the risk of having every transaction recorded while being fully programmable, which means financial institutions and their customers could have total control over where, when, and how your money is spent.

Bank of Russia deputy governor Alexey Zabotkin gave a real world example of what CBDC programmability could look like when he spoke at the annual cybersecurity training exercise Cyber Polygon back in 2021.

There, Zabotkin explained:

“This [digital ruble] will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency.

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food, for example.

“That would be a useful functionality for a customer, and of course you can come up with hundreds of other similar use cases.”

Speaking at a high-level roundtable on CBDC in Washington, DC in October 2022, IMF deputy managing director and former People’s Bank of China (PBoC) deputy governor Bo Li said of CBDC programmability:

“CBDC can allow government agencies and private sector players to program — to create smart contracts — to allow targeted policy functions. For example, welfare payment; for example, consumption coupons; for example, food stamps.”

“By programming CBDC, those [sic] money can be precisely targeted for what kind of people can own and what kind of use this money can be utilized,” he added.

Last month, India’s digital ID architect Nandan Nilekani told the IMF that everybody should have a digital ID, a bank account, and a smartphone as they were the “tools of the New World” for digital public infrastructure.

“If you think, ‘what are the tools of the New World?‘ — Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone,” said Nilekani.

“Then, anything can be done. Everything else is built on that.”

India, too, is launching a CBDC pilot program that is exploring different use cases, such as setting expiry dates.

According to the Reserve Bank of India, “CBDCs have the possibility of programming the money by tying the end use.”

When it comes to retail transactions, CBDC “tokens may have an expiry date, by which they would need to be spent, thus ensuring consumption.”

Ultimately, a CBDC linked with digital identity could allow governments and corporations to put permissions on what you can buy with your own money, including expiry dates on when you can spend it.

The ECB claims that it will not make a decision on whether or not it will actually go through with developing the CBDC until October of this year.

After all the time, energy, and resources invested in exploring the digital euro, do you really believe the European Central Bank would just walk away and abandon it?