The heads of both the American Federal Reserve and the European Central Bank confirm Central Bank Digital Currencies (CBDC) would not be anonymous, which paves yet another path for all-encompassing digital identity schemes.

On September 27, France’s central bank — the Banque de France — held an international roundtable in which central bankers from the US and the EU confirmed that digital dollars and euros, should they go forward, would not be anonymous.

In other words, these Central Bank Digital Currencies (CBDC) would require some form of digital identity scheme.

CDBC also run the risk of having every transaction recorded while being fully programmable, which means central banks and/or their customers could have total control over where, when, and how your money is spent.

“It [CBDC] would not be anonymous. It would not be an anonymous bearer instrument” — Jerome Powell, Federal Reserve, 2022

During the international roundtable, Federal Reserve Chair Jerome Powell said that with respect to an American CBDC rollout:

“If we were to pursue a CBDC, it would at the minimum have the following four characteristics:

“First is intermediated. Second is privacy protected.

“The third is identity verified, so it would not be anonymous. It would not be an anonymous bearer instrument.

“And fourth is transferable or interoperable.

“So, we would be looking to balance privacy protection with identity verification, which has to be done of course in today’s traditional banking system as well.”

“We would be looking to balance privacy protection with identity verification” — Jerome Powell, Federal Reserve, 2022

“In terms of anonymity, there would not be complete anonymity as there is with bank notes” — Christine Lagarde, European Central Bank, 2022

In the same vein as her American counterpart, European Central Bank president Christine Lagarde also acknowledged that a digital euro would not be anonymous.

“When we surveyed Europeans, the first concern that they had in addition to the support to the digital euro was privacy,” said Lagarde, adding, “privacy is first and foremost on their mind when we develop the digital euro.

“In terms of anonymity, there would not be complete anonymity as there is with bank notes, for instance, but there would be a limited level of disclosure and certainly not at the central bank level.”

In the absence of complete anonymity, a digital identity system would need to be in place.

Lagarde said that this would not take place at the central bank level, at least not in the European Union, so to whom will digital identity schemes be delegated?

“Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity” — Bank for International Settlements, Annual Economic Report, 2021

“By drawing on information from national registries and from other public and private sources, such as education certificates, tax and benefits records, property registries etc, a digital ID serves to establish individual identities online” — Bank for International Settlements, Annual Economic Report, 2021

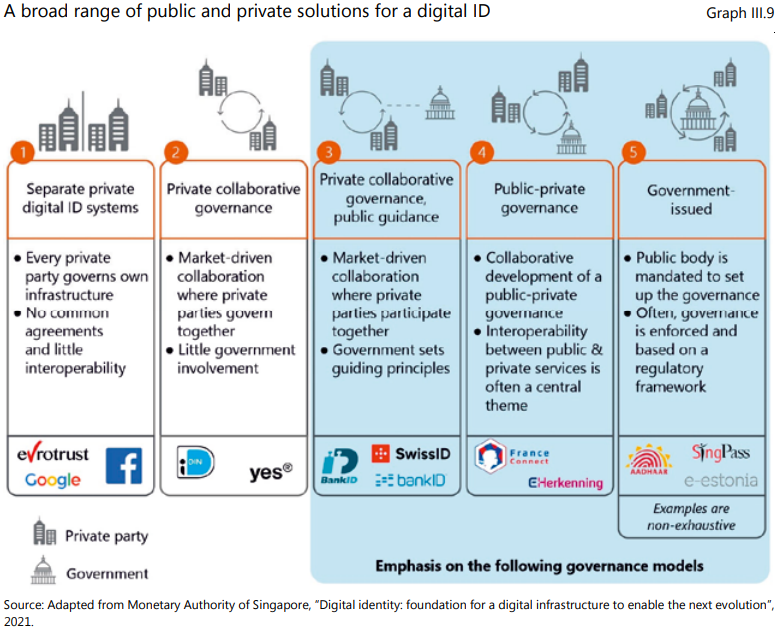

To get a clearer understanding of which entities could be in charge of handling digital identity schemes related to CBDC, the Bank for International Settlements (BIS) annual economic report for 2021 highlighted five scenarios using public and private entities (see image above):

- Separate Private Digital ID Systems

- Private Collaborative Governance

- Private Collaborative Governance, Public Guidance

- Public-Private Governance

- Government-Issued

According to the 2021 BIS report, “A digital identity scheme, which could combine information from a variety of sources to circumvent the need for paper-based documentation, will thus play an important role in such an account based design.”

This digital identity, according to the BIS, would draw on “information from national registries and from other public and private sources, such as education certificates, tax and benefits records, property registries, etc.”

“The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement” — Bank for International Settlements, Annual Economic Report, 2021

Apart from eliminating the anonymity that physical bank notes provide while requiring some form digital identity scheme to operate, CBDCs may be fully programmable, meaning central banks and their customers could have total control over when, where, and how the money is spent.

According to the BIS Annual Economic Report 2022, “New capabilities such as programmability, composability and tokenization are not the preserve of crypto, but can instead be built on top of central bank digital currencies.”

The report goes on to say that “industry could benefit from CBDCs, which could underpin a decentralized system, by enabling regulated financial institutions to issue programmable money.”

“A key difference with a CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also, we will have the technology to enforce that” — Agustin Carstens, Bank for International Settlements, 2020

“New capabilities such as programmability, composability and tokenization are not the preserve of crypto, but can instead be built on top of central bank digital currencies” — Bank for International Settlements, Annual Economic Report, 2022

Speaking at an International Monetary Fund (IMF) seminar on October 19, 2020, BIS general manager Augustin Carstens explained that a CBDC gives the central bank both “absolute control” over the use of the CBDC, along with the technology to enforce that control.

“We tend to establish the equivalence with cash, and there is a huge difference there,” Carsten said in 2020.

“For example, in cash we don’t know for example who’s using a 100 dollar bill today. We don’t know who is a 1,000 peso bill today.

“A key difference with a CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also, we will have the technology to enforce that.

“Those two issues are extremely important, and that makes a huge difference with respect to what cash is.”

“This [digital ruble] will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency” — Alexey Zabotkin, Bank of Russia, Cyber Polygon 2021

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food” — Alexey Zabotkin, Bank of Russia, Cyber Polygon 2021

To provide a clearer example of potential CBDC use cases, Russia’s central bank has been working on a digital ruble that, according to Bank of Russia deputy governor Alexey Zabotkin, would “permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency.”

Speaking at the WEF-backed, Russian-based Cyber Polygon 2021 cybersecurity training exercise, Zabotkin highlighted how CBDCs could be programmed with restrictions.

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food, for example,” he said.

“That would be a useful functionality for a customer, and of course you can come up with hundreds of other similar use cases,” Zabotkin added.

Programming people’s access to products, services, and information with CBDCs and digital IDs lays the foundation for a system of social credit scoring like that of the Chinese Communist Party.

“This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us” — World Economic Forum

“It is a mistake to equate and reduce the wide spectrum of digital fiat currency architectures […] to the more limited category of CBDC, which refers only to those models in which central banks are the exclusive issuers and administrators” — Rohan Grey, Congressional Testimony, 2021

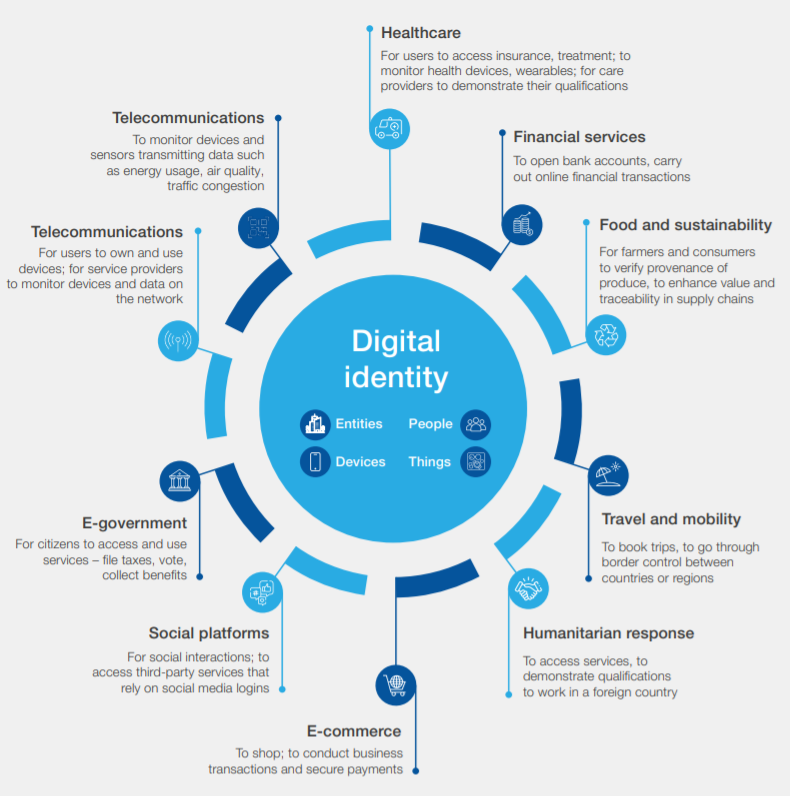

Eliminating anonymity from money means that every transaction would be recorded and pegged to a user’s digital identity.

“This digital identity,” according to the World Economic Forum (WEF), “determines what products, services and information we can access – or, conversely, what is closed off to us.”

To sell their technocratic agenda of surveillance and control, public and private entities may initially say digital ID and CBDCs won’t replace plastic credentials or paper cash and that there will still be the option to use both — all while guaranteeing top-notch cybersecurity and privacy.

But once digital ID and CBDC reach a certain level of acceptance and adoption by the general public, the option to go back to physical cash can be quietly eliminated with little-to-no pushback.

In fact, a WEF Agenda blog post from September, 2017 lists the “gradual obsolescence of paper currency” as being “characteristic of a well-designed CBDC.”

“Transactional anonymity, like anonymity more broadly, is a public good and a core bedrock of political freedom in a democratic society” — Rohan Grey, Congressional Testimony, 2021

A CBDC linked with digital ID would allow governments and corporations to put permissions on what you can buy with your own money, including expiration dates on when you can spend it.

As the push for individual carbon footprint trackers intensifies among powerful public and private entities, you may one day wake up in a world where you are no longer able to use your digital currency to travel long distances, purchase gasoline, or even buy meat because your digital identity says you’ve exceeded your carbon limit.

And if you attempt to speak out against these totalitarian policies, you may also find yourself blacklisted, de-platformed, de-monetized, and cut-off from your digital funds.

Testifying before congress on the subject of a digital dollar in June, 2021, expert witness Rohan Grey warned, “It is not difficult to envisage a future in which political donations, even within the United States, become increasingly subject to censorship and monitoring by those in control over the technological means of payment.”

He added, “Transactional anonymity, like anonymity more broadly, is a public good and a core bedrock of political freedom in a democratic society.”

Now, central bankers around the world are confirming that their CBDC would not have the transactional anonymity that Grey referred to as “a core bedrock of political freedom in a democratic society.”

Digital ID and CBDC risk creating a system of complete financial and social control that manipulates, coerces, or otherwise incentivizes changes in human behavior while eliminating a citizen’s agency, autonomy, and anonymity.