The Bank for International Settlements (BIS) publishes a report proposing that digital ID, Central Bank Digital Currency (CBDC), and tokenization can facilitate trust in money flows.

The BIS working paper “Trust Bridges and Money Flows” envisions a future where CBDCs and tokenized money are linked with digital identity and stored on a [unified] electronic ledger.

“In the realm of credit-based money, trust plays a key role,” the report reads, adding, “Trust in the holder of money can be facilitated by national (digital) identity systems, sanctions lists, and […] infrastructure.”

The authors also make the case that tokenized money would lead to greater trust in cross border payments.

“The tokenization of money alters trust links and allows for a potentially more efficient market structure to exchange money”

Trust Bridges and Money Flows, BIS, July 2023

However, “tokenized money is not associated with anonymity,” according to the report, adding, “the identity of token owners and the nature of transactions can still be monitored by appropriate parties.”

That’s where digital identity comes into play. Transactions won’t be anonymous like with physical cash.

“A new type of financial market infrastructure – a unified ledger – could capture the full benefits of tokenization by combining central bank money, tokenized deposits and tokenized assets on a programmable platform”

Blueprint for the Future Monetary System, BIS, June 2023

“The key ingredient of tokenized money is the electronic ledger, not the full decentralization as in distributed ledger technologies”

Trust Bridges and Money Flows, BIS, July 2023

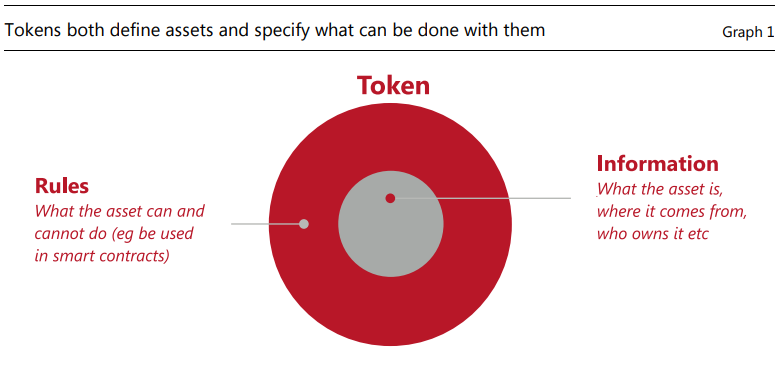

Last month the BIS published a report called, “Blueprint for the future monetary system: improving the old, enabling the new,” which further explains how tokens actually work.

Basically, a token comes with both the “rules” on what the asset can and cannot do (programmability) and the background “information” on what the asset is, who owns it, and where it comes from.

When bankers and economists talk about programmability in token-based CBDCs, they are talking about rules being applied to when, where, and how you can spend your money.

“You could have a potentially […] darker world where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort“

Eswar Prasad, WEF Annual Meeting of the New Champions, June 2023

As Cornell University professor Eswar Prasad told the World Economic Forum (WEF) last month:

“If you think about the benefits of digital money, there are huge potential gains. It’s not just about digital forms of digital currency; you can have programmability — units of central bank currency with expiry dates.

“You could have […] a potentially better — or some people might say a darker world — where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort, and that is very powerful in terms of the use of a CBDC, and I think also extremely dangerous to central banks.”

While Prasad highlighted that programming CBDC for economic or social policies could affect the integrity of central banks, European Central Bank president Christine Lagarde recently explained that programmability would be left to commercial banks.

“For us [central banks], the issuance of a digital currency that would be central bank money would not be programmable […] Those who can associate the use of digital currency with programmability would be the intermediaries — would be the commercial banks”

Christine Lagarde, BIS Innovation Summit, March 2023

In March, Lagarde said that a central bank would not be in charge of programming a digital currency.

“For us [central banks], the issuance of a digital currency that would be central bank money would not be programmable — would not be associated with any particular limitation, whether it’s in time, in type of use — that to me would be a voucher. It wouldn’t be a digital currency,” said Lagarde.

“Those who can associate the use of digital currency with programmability would be the intermediaries — would be the commercial banks.

“And that’s their business. They know how to do that, but if we are to say that a dollar is a dollar, whether it is cash or digital; or a euro is a euro, cash or digital — then for us [central bank] it cannot be programmable.

“It can be associated with conditionality, which is different, but not programmable,” she added.

Speaking at a high-level roundtable on CBDC in Washington, DC in October 2022, International Monetary Fund (IMF) deputy managing director and former People’s Bank of China (PBoC) deputy governor Bo Li said of CBDC programmability

“By programming CBDC, those money can be precisely targeted for what kind of people can own and what kind of use this money can be utilized“

Bo Li, IMF, October 2022

Speaking at a high-level roundtable on CBDC in Washington, DC in October 2022, International Monetary Fund (IMF) deputy managing director and former People’s Bank of China (PBoC) deputy governor Bo Li said of CBDC programmability:

“CBDC can allow government agencies and private sector players to program — to create smart contracts — to allow targeted policy functions. For example, welfare payment; for example, consumption coupons; for example, food stamps.”

“By programming CBDC, those money can be precisely targeted for what kind of people can own and what kind of use this money can be utilized,” he added.

So, while Lagarde says that central banks have no interest in programming CBDCs, central banks around the world are indeed exploring programmability, even if the central banks themselves are not the ones doing the actual programming.

“What type of CBDC designs could be launched without programmability but would leave open the capability to introduce it at a future date, if needed, without requiring a major redesign?“

Central bank digital currencies: ongoing policy perspectives, BIS, May 2023

In May the BIS published a 10-page report called “Central bank digital currencies: ongoing policy perspectives,” which questioned if programmability could be introduced via the backdoor following a CBDC launch.

While the BIS acknowledged that blockchain could aid in programmability, the central bank for central banks pondered whether or not blockchain was actually necessary, and if programmability could be introduced later on.

According to the report, “The use of blockchain technology within CBDC systems remains a possibility, although it is not deemed essential to the functioning of a potential CBDC system.”

However, “There may be ancillary uses for blockchain technology, and associated concepts from within the cryptoasset ecosystem, that could potentially extend the functionality of a CBDC (eg enabling certain types of programmability, micropayments).“

“At the IMF we are working hard on the concept of a global CBDC platform to trade and to manage risks“

Kristalina Georgieva, IMF, June 2023

Speaking at an event in Morocco last month, International Monetary Fund (IMF) managing director Kristalina Georgieva said that CBDCs needed to be interoperable between countries and that the IMF was working on the concept of a global CBDC platform for that reason.

“If we are to be successful, CBDCs could not be fragmented national propositions,” said Georgieva.

“To have transactions more efficient and fairer, we need systems that connect countries.

“In other words, we need interoperability.

“For this reason, at the IMF we are working hard on the concept of a global CBDC platform to trade and to manage risks,” she added.

At the same conference in Morocco, the IMF’s Tobias Adrian, who also co-authored yesterday’s BIS report on “Trust Bridges and Money Flows,” said that there was great potential in tokenizing assets and money and that “tokenized deposits themselves could be escrowed and exchanged directly.”

Given that a token can be a digital representation of money, goods, assets, and rights on a programmable platform, the next step is to tokenize just about everything in nature.

“We start thinking about putting prices on water, on trees, on biodiversity […] How do we start tokenizing?“

Michael Sheren, COP27, November 2022

Speaking at COP27 in Egypt last year, former Bank of England Advisor Michael Sheren said that carbon was “moving very quickly into a system where it’s going to be close to a currency,” and that next on the agenda was the tokenization of nature and biodiversity, where places like Indonesia, Brazil, and Africa would be “absolutely critical.”

“Carbon, we already figured out,” he said, adding, “carbon is moving very quickly into a system where it’s going to be very close to a currency, basically being able to take a ton of absorbed or sequestered carbon and being able to create a forward-pricing curve, with financial service architecture, documentation.”

According to Sheren, “The southern part of the world has value far greater than large elements of the northern part.

“And we start thinking about putting prices on water, on trees, on biodiversity, we find where does that sit […]

“How do we start tokenizing?” he added.

Image by Freepik