UPDATE September 20, 2024: The WEF has brought back the session on “Valuing Nature’s Assets” to the Sustainable Development Impact Meetings. This article, including the headline has been updated to include that information.

On September 17 the World Economic Forum (WEF) deleted a session entitled, “Valuing Nature’s Assets,” from its Sustainable Development Impact Meetings 2024 program.

However, that session reappeared again on Friday, September 20.

With the WEF Sustainable Development Impact Meetings 2024 taking place September 23-27, the unelected globalist organization for public-private collaboration made some tweaks to its program, most notably on September 17 with the elimination of a session entitled “Valuing Nature’s Assets,” which was originally scheduled for Thursday, September 26.

The screenshot below is taken from a WEF Agenda article published on September 16 called, “SDIM24: Full coverage on Climate, Nature and Energy from the World Economic Forum.”

The antiquated hyperlink to the session implies that it was originally going to be called “Capitalizing on Nature’s Assets,” before the name change.

The reason behind the recent scrubbing and then un-scrubbing could’ve been for a variety of reasons, including something as simple as changes in the speakers’ availability.

However, capitalizing on natural assets has been on the globalist agenda for quite some time.

For example, one of the sessions held last June at the WEF “Annual Meeting of the New Champions,” aka Summer Davos, was dedicated to “Understanding Nature’s Ledger.”

There, University of Cambridge Institute for Sustainability Leadership CEO Lindsay Hooper told the panel on “Understanding Nature’s Ledger” that every part of the economy depends on nature, and that in order to protect natural systems, one solution would be to “bring nature onto the balance sheet.”

“We can’t do business on a dead planet. If we’re going to protect natural systems, one of the solutions is to bring nature onto the balance sheet”

Lindsay Hooper, WEF Annual Meeting of the New Champions, 2024

Hooper also suggested that nature should not be treated within the economy as though it were free and unlimited.

“At the moment, the way that decisions are made on an every day level within businesses and financial institutions is because we’re looking at financial data metrics that are not factoring-in nature,” said Hooper.

“Nature is treated within the economy as though it’s unlimited, and predominantly as though it’s free.”

“Without these forms of value, these forms of natural capital, we won’t have economies. They are the fundamental building blocks of our economies”

Lindsay Hooper, WEF Annual Meeting of the New Champions, 2024

Why does Hooper believe that nature should be factored-in to financial data metrics?

According to her, it’s because “every part of the economy is fundamentally dependent on nature,” including, “the air that we breathe, the water we drink, the soil, the oceans that we need for the food that we need to consume, the minerals that we need as inputs to technology and into infrastructure.

“Without these forms of value, these forms of natural capital, we won’t have economies. They are the fundamental building blocks of our economies.”

In addition to putting “nature on the balance sheet,” another proposal coming at the end of the panel discussion suggested putting a tax on natural systems like water in the same vein as carbon taxes.

In her presentation during the same session, WEF managing director for nature and climate Gim Huay Neo said that “integrating natural capital to our accounting framework” should happen soon.

“Beyond carbon [taxes] let’s think about other aspects of nature that are easier to quantify […] What about water?”

Gim Huay Neo, WEF Annual Meeting of the New Champions, 2024

“We need to keep pushing while continuing to refine and enhance, and the best example I can give is carbon pricing,” said Neo.

“Today, carbon pricing, ETS [Emissions Trading Systems], carbon taxes really cover about 25 percent of global emissions.

“We should actually look at scaling this to cover all 100 percent of carbon emissions.

“And beyond carbon let’s think about other aspects of nature that are easier to quantify.

“We will probably not be able to quantify everything on day one, but what about water?

“That’s quite possible for us to start integrating systematically into current trading carbon pricing mechanisms,” she added.

“We start thinking about putting prices on water, on trees, on biodiversity […] How do we start tokenizing? How do we start building systems that actually create not only the value, but transfer that value around the world?”

Ex-Bank of England Advisor Michael Sheren, COP27, 2022

At COP27 in November 2022, former Bank of England advisor and G20 co-chairman Michael Sheren said that carbon was “moving very quickly into a system where it’s going to be close to a currency,” and that next on the agenda was the tokenization of nature and biodiversity, where places like Indonesia, Brazil, and Africa would be “absolutely critical.”

“Carbon, we already figured out, and carbon is moving very quickly into a system where it’s going to be very close to a currency, basically being able to take a ton of absorbed or sequestered carbon and being able to create a forward-pricing curve, with financial service architecture, documentation,” said Sheren.

And with carbon being close to a currency, “There are going to be derivatives.”

Next on the agenda is the tokenization of water, trees, and just about everything else in nature.

“We start thinking about putting prices on water, on trees, on biodiversity, we find where does that sit?” Sheren pondered.

“How do we start tokenizing? How do we start building systems that actually create not only the value, but transfer that value around the world?”

Investigative journalist Whitney Webb has been sounding the alarm on the tokenization of natural assets and the establishment of Natural Asset Corporations (NACs) for quite some time.

“NACs, once they lay claim to the natural asset they identify, launch an IPO and become the issuers of shares in that natural asset which are then sold to institutional and individual investors, corporations, sovereign wealth funds, etc., thereby fractionalizing the natural asset the NAC was created to capture”

Whitney Webb and Mark Goodwin, “Tokenized, Inc: BlackRock’s Plan To Own The Fractionalized World,” Bitcoin Magazine February 2024

Writing for Bitcoin Magazine alongside its editor-in-chief Mark Goodwin last February, the authors highlighted that “Some companies have already moved to tokenize these natural assets to facilitate and accelerate their financialization and fractionalization” while “some national governments have already made plans to tokenize their land and natural assets, namely the Central African Republic.”

In August, Webb and Goodwin warned in an investigative report on Unlimited Hangout called “‘Sustainably’ Surveilling and Tokenizing Nature: The Case of O.N.E. Amazon” what tokenization nature really looks like in practice.

“The race is on to tokenize real world assets, especially the natural world and natural resources, in order to perpetuate the debt-based monetary system that has enabled the theft of regular people’s wealth for centuries,” they write.

“Framed in altruistic terms of ‘helping’ the environment and the have-nots, we are instead witnessing the ‘datafication’ of all life both for profit and so that all life – including human beings and the natural world – can be surveilled, eventually down to the molecular level, and then ‘managed’ by intelligent machines.

“Such a paradigm does not represent ‘conservation’ or ‘preservation,’ but rather the onboarding of our greatest natural treasures onto a system of hi-tech control, with every flutter of a butterfly wing and every branch swaying in the breeze being converted into bits and bytes that predatory bankers can trade and speculate on for profit.”

With the “Valuing Nature’s Assets” session back on the menu for this year’s WEF Sustainable Development Impact Meetings program, the agenda is still in full swing.

Next week’s meetings will include a session with John Kerry, WEF president Borge Brende, and European Climate Foundation CEO Laurence Tubiana called “It’s Not Easy Trading Green,” which will explore “How should business and government collaborate to create trade frameworks that promote economic development while supporting next-generation technologies and ensuring environmental sustainability?“

Another high-level session called “Putting COPs’ Pledges into Practice” asks the question, “How can actors from the public and private sector move beyond current geo-economic tensions and take the necessary actions to curb carbon emissions and halt biodiversity loss while ensuring a more inclusive economy?“

During last year’s WEF Sustainable Development Impact Meetings 2023, we saw the fusion of the great reset and the great narrative agendas on COVID and climate in under two minutes.

“The pandemic was an opportunity […] How now do we take the emotion of the health factor, [which] is so critical, but guess what guys? The climate crisis is creating more health issues than you can ever imagine, but no one has been able to make that link in the past”

Jemilah Mahmood, WEF Sustainable Development Impact Meetings, 2023

There, panelists Jemilah Mahmood, executive director at Malaysia’s Sunway Centre for Planetary Health; and Vanessa Kerry, CEO at Seed Global Health, special envoy for climate and health at the World Health Organization (WHO), and daughter of former US climate czar John Kerry; regurgitated the words of WEF founder Klaus Schwab from his great reset declaration that the pandemic was an opportunity that needed to be applied to the climate change narrative.

According to Mahmood,“The pandemic was an opportunity […] How now do we take the emotion of the health factor, [which] is so critical, but guess what guys? The climate crisis is creating more health issues than you can ever imagine, but no one has been able to make that link in the past.”

Kerry was quick to respond to Mahmood about the narratives linking COVID and climate, stating:

“COVID taught us all these lessons learned, and we should be incorporating that, and the climate crisis is going to be so much worse […] but people have forgotten and don’t care, so how do we keep that front-and-center?”

The answer to conflating COVID with climate, according to Mahmood, echoed that of Klaus Schwab’s “great narrative” declaration from November, 2021 — that storytelling would fill the void.

Mahmood responded to Kerry, saying:

“Have people forgotten about COVID? I think it’s about the storytelling element. I think that a lot of the things we say on health are very doom and gloom; very, very much; even on the climate issues […] But telling really inspiring stories about what is possible […] with very little resources, you can create very high impact.”

A year prior, at the WEF Sustainable Development Impact Meetings 2022, United Nations Under-Secretary-General for Global Communications Melissa Fleming highlighted that the UN had partnered with several big tech companies, including TikTok and Google, to control COVID and climate narratives while claiming, “We own the science.”

“We own the science, and we think that the world should know it, and the platforms themselves also do“

Melissa Fleming, WEF Sustainable Development Impact Meetings, 2022

On the topic of controlling the climate change narrative, Fleming remarked that the UN had partnered with Google, so that the unelected globalists’ authoritative narratives would appear at the top of search results.

“We partnered with Google,” said Fleming, adding, “for example, if you Google ‘climate change,’ you will, at the top of your search, you will get all kinds of UN resources.

“We started this partnership when we were shocked to see that when we Googled ‘climate change,’ we were getting incredibly distorted information right at the top.

“We’re becoming much more proactive. We own the science, and we think that the world should know it, and the platforms themselves also do,” she added.

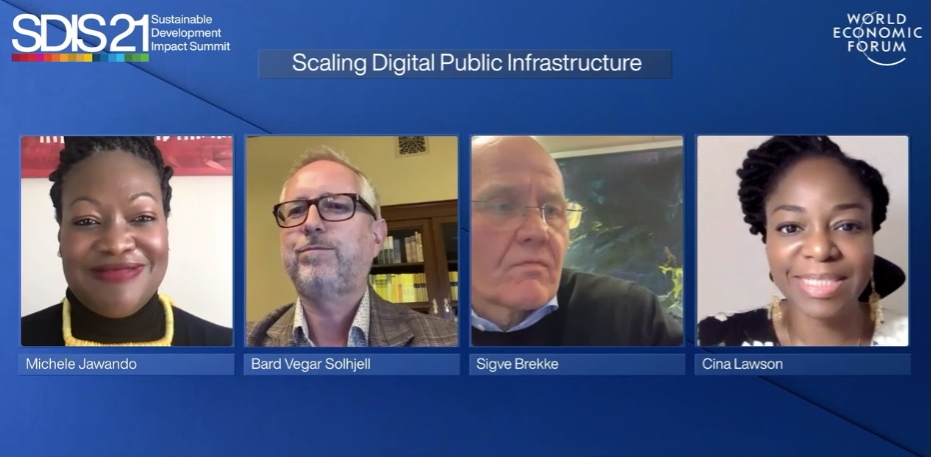

And going back to the WEF Sustainable Development Impact Summit 2021, we got an early glimpse into the concept of Digital Public Infrastructure (DPI), which is civic technology stack now championed by the UN and the Bill and Melinda Gates Foundation.

DPI consists of three components: digital ID, fast payments systems, and massive data sharing.

“Expanding access to digital identity can unlock economic value equivalent by up to 13% of national GDPs by 2030. How can public-private cooperation scale critical infrastructure such as digital identity, e-payments and data exchanges to accelerate digital inclusion and build competitive digital economies?”

“Scaling Digital Public Infrastructure,” WEF Sustainable Development Impact Summit, 2021

All participants in the 2021 “Scaling Public Digital Infrastructure” session, from the moderator to the panelists, were in some way connected to digital identity projects.

- Michele Lawrence Jawando, Moderator: Senior Vice-President of Programmes at the Omidyar Network

- The Omidyar Network is a funder of the Modular Open Source Identity Platform (MOSIP), which “helps governments and other user organizations implement a digital, foundational identity system.”

- In 2016, the Omidyar Network first introduced the concept of “Good ID,” which “extends beyond the goal of national or ‘legal identity for all,’” and “applies to all types of digital identities (issued ID, defacto ID or data trails, and self-asserted ID).”

- The Omidyar Network is an endorsing organization of the World Bank’s “Principles on Identification for Sustainable Development.”

- Sigve Brekke, Panelist: President and CEO at Telenor Group

- Telenor Digital ID leverages core telco capabilities and enables subscribers with a secure login to all services

- Bård Vegar Solhjell, Panelist: Secretary-General at the Norwegian Agency for Development Cooperation (NORAD)

- Norad is a founding partner of the MOSIP platform for Digital Identity, funded in-part by the Omidyar Network.

- Norad is also an endorsing organization of the World Bank’s “Principles on Identification for Sustainable Development.”

- Cina Lawson, Panelist: Minister of Digital Economy and Transformation for Togo’s Ministry of Posts, Digital Economy and Technological Innovation

- Togo is developing a nationwide biometric digital ID scheme that can be integrated across national systems

The WEF Sustainable Development Impact Meetings 2024 will take place from September 23-27.

Image [AI-generated] by freepik