For small to medium-sized business owners, having a trustworthy payments solution is crucial not only for growth, but for protection against fraud and losses.

In 2013 there were almost 28 million small businesses operating in the US. As the majority of small business owners employ little-to-no staff, this makes finding a trustworthy payments processing company even more difficult.

With the digital transformation taking place across platforms, small businesses need to keep up with the changing industry. Small business owners also need to be informed about security measures to protect against fraud, as well as educate themselves about hidden fees that lurk in the back pages of more disreputable types in the payments industry.

According to a Business Solutions magazine report, “Much of the payment industry’s tarnished reputation hasn’t come only from ISOs that were dishonest or misleading; it also springs from ISOs who fail to disclose hidden fees within the agreements to prospects.”

To learn more about the tech and business of today’s payments processing industry, especially as it relates to small and medium-sized businesses, I spoke with Mark Spirek, CTO of Tidal Commerce.

The Business Side

Spirek and the Tidal Commerce team recognize that business owners shouldn’t have to deal with unnecessary locked contracts, nor should they have to believe the sensationalism of cold-call scammers that claim to offer rates that seem too good to be true.

Instead, the Tidal Commerce model is very personable and down-to-earth, which includes simple and transparent pricing, no hidden fees, no setup fees, and no cancellation fees.

The company has also launched a new, even more transparent pricing plan where merchants pay just $15 per month, as well as 1.99% and 25 cents per typical transaction.

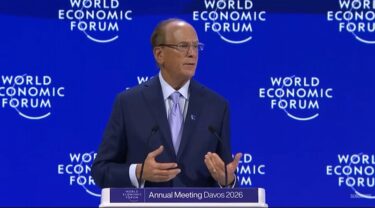

Tidal Commerce CEO Drew Sementa

CEO Drew Sementa has been in the industry for 15 years, and he has seen how it has evolved as well as all the shady tactics from other payments processors that have come and gone over the years.

Sementa’s approach to business is simple, “We need to earn your business every month.”

Hard work, experience, and honesty are why Tidal Commerce has positioned itself as a leader in the industry, and they truly help businesses grow. With solutions that evolve along with their customers, their prices evolve as well.

Once a business starts growing, “We can reevaluate pricing methods for them to save even more money,” says Spirek.

The Tech Side

Apart from being a cloud-powered merchant services for businesses, Tidal offers some great hardware as well.

Now, with the launch of the first all-in-one smart terminal Point of Sale (POS) system, Tidal Commerce has given the world a sleek piece of hardware to manage business like never before.

Features like a built in printer, hybrid card reader and multiple connectivity options provide businesses with the flexibility they require, and can integrate 3rd-party tools to help add new products, view order histories, or issue returns.

Tidal Commerce’s tech is also compatible with most terminals, POS systems, and software on the market, unlike most competitors.

The all-in-one Tidal Smart Terminal is powered by Poynt, and provides merchants with an accessible and easy way to process payments for a quarter of the price of traditional POS systems.

“Our intuitive solutions are not only cost-effective for growing businesses, but are designed to continue providing value as they scale,” said Sementa.

Educating to protect against fraud

The team not only has a wealth of experience in the industry, but they also share their knowledge to educate their customers about the best solutions most suitable to them and even how to protect against fraud.

“Fraud is increasingly becoming a problem in the online world as online shopping has become more and more popular,” informs the Tidal Commerce blog.

One of the ways Tidal Commerce educates businesses on how to prevent fraud is by explaining the importance of security measures, such as using EMV chips, and how they work.

The term EMV refers to Europay, MasterCard, and Visa — the payment processing companies that developed the system.

Tidal Commerce helps its customers understand that “EMV can protect your business against fraudulent chargebacks and charges. Before EMV, the merchant was financially and legally responsible if there was a fraudulent charge. Now the entity with the less secure payment system that does not accept EMV payments is liable. For example, if you have a customer that comes in and wants to make a purchase and your payment terminal can’t process their chip card, you may be responsible for any fraudulent charges since the EMV technology could have prevented it.”

With a solid business model, great tech, and the desire to educate and save customers money while helping them grow, Tidal Commerce is an honest solution that boasts 12 years without a single complaint with the Better Business Bureau.