Queen Maxima of the Netherlands tells the World Economic Forum (WEF) in Davos that digital ID is good for knowing “who actually got a vaccination or not” and for financial inclusion.

On Thursday the Dutch queen continued her crusade to see universal adoption of digital ID because she believes it is good for everything from opening a bank account to enrolling in school and for providing proof of vaccination, aka “vaccine passports.”

“It [digital ID] is also good for school enrollment; it is also good for health — who actually got a vaccination or not; it’s very good actually to get your subsidies from the government”

Queen Maxima of the Netherlands, United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, WEF Annual Meeting 2024

Speaking at the WEF annual meeting panel entitled “Comparing Notes on Financial Inclusion” Her Majesty said:

“In order to open up an account, you need to have an ID. I have to say that when I started this job, there were actually very little countries in Africa or Latin America that had one ubiquitous type of ID, and certainly that was digital and certainly that was biometric.

“We’ve really worked with all our partners to actually help grow this, and the interesting part of it is that yes, it is very necessary for financial services, but not only.”

Beyond financial services, Queen Maxima said that digital ID was good for proving an individual’s vaccination status:

“It is also good for school enrollment; it is also good for health — who actually got a vaccination or not; it’s very good actually to get your subsidies from the government.”

The Dutch queen also highlighted that for the past 10 years, she had been working on developing Digital Public Infrastructure (DPI), which is a digital stack consisting of digital ID, digital payments systems like Central Bank Digital Currencies (CBDCs), and massive data sharing.

“We’ve been working in the last 10 years on a notion that we call Digital Public Infrastructure. In our experiences in different countries, to actually have these sort of things that are actually very important,” the queen told the WEF panel.

“One of these is IDs, e-signature, digital ID, so that’s extremely important, even having a QR code legislation is very important,” she added.

Last November, the United Nations and the Bill and Melinda Gates Foundation launched their 50-in-5 campaign to get 50 countries to rollout at least one DPI component within the next five years.

“Digital public infrastructure (DPI) – which refers to a secure and interoperable network of components that include digital payments, ID, and data exchange systems – is essential for participation in markets and society in a digital era“

50-in-5 Campaign

As the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, Queen Maxima has been pushing the digital ID agenda for a number of years.

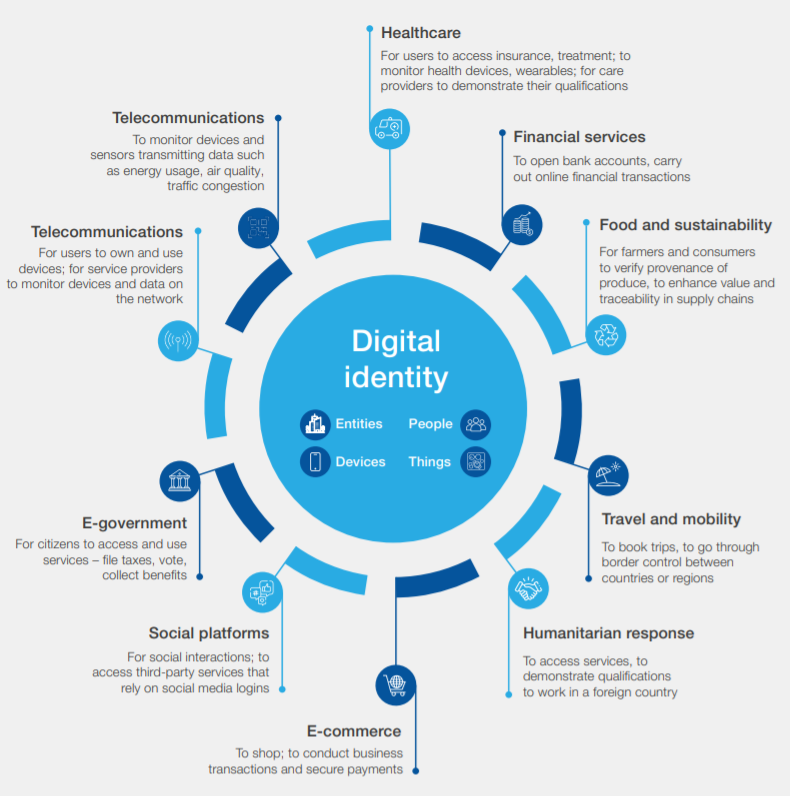

Vaccine passports, by their very nature, serve as a form of digital identity, according to the WEF.

And the WEF envisions digital identity being linked to everything from financial services and healthcare records to travel, mobility, and digital governance.

A WEF report on “Reimagining Digital ID” published in June 2023, says:

- “Digital ID may weaken democracy and civil society.”

- “The greatest risks arising from digital ID are exclusion, marginalization and oppression.”

- Requiring any form of ID risks exacerbating fundamental social, political and economic challenges as conditional access of any kind always creates the possibility of discrimination and exclusion.”

“This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us”

Digital Identity Insight Report, WEF, 2018

Queen Maxima is also a staunch advocate for Central Bank Digital Currencies (CBDCs), which cannot operate without a digital ID.

According to the Bank for International Settlements (BIS) Annual Economic Report 2021:

“The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement.”

“Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity“

Bank for International Settlements Annual Economic Report 2021

At this very moment, governments and central banks all over the world are exploring how to implement Central Bank Digital Currencies that are inextricably linked with pegging every citizen to a digital identity.

A CBDC adds another layer to digital ID, in that it can program permissions on purchases.

Speaking at the WEF’s 14th Annual Meeting of the New Champions, aka “Summer Davos,” in Tianjing, China last year, Cornell University professor Eswar Prasad explained that governments could program CBDCs to restrict undesirable purchases and set expiry dates.

“You could have a potentially […] darker world where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort“

Eswar Prasad, WEF Annual Meeting of the New Champions, June 2023

The theme of this year’s WEF Annual Meeting is “Rebuilding Trust.”

Kicking off the meeting this week in his welcome address, WEF founder Klaus Schwab appointed himself and the Davos crowd “trustees” over humanity’s future.